Introduction

Are you a beginner in the stock market and want to invest some of your income? Do you want to take off on a journey toward wealth creation through systematic investment plans (SIPs) or mutual funds? If your answer is “yes” to both questions, then this blog post has got you covered. In this blog post, I will guide you through the step-by-step process of using the 5Pasa app for investing in stocks and mutual funds. So, settle in, grab a cup of steaming coffee, and let’s delve deep into the details of maximizing your investment potential through the 5paisa app.

Before moving ahead, here’s a highlight of the blog post.

1. What is the 5paisa?

2. How does the 5paisa work?

3. Is the 5-paisa safe in India?

4. How Do I Use the 5paisa for Mutual Fund Investment?

5. How to Use the 5paisa for Share Investment?

What is the 5paisa?

5paisa was introduced by the IIFL in 2016. It stands out as the pioneer in the discount brokerage sector, offering both share trading and financial advisory services within a single app, all of that at the lowest cost. Impressively, they have garnered a vast customer base of approximately 2.9 million users.

5paisa, known as a low-cost financial service provider, offers online trading, mutual funds, and insurance with the most competitive brokerage charges. With a straightforward pricing plan, they provide trading in various segments like equity, futures and options, intraday, and currency derivatives at a flat brokerage rate of Rs. 20 per order.

How do I create an account and complete KYC on the 5paisa?

Here comes the main part of the blog post, which is how to use 5paisa for your stock or derivatives and mutual fund investments in India.

To start investing in stocks or trading stocks and derivatives through 5paisa, individuals need to open a 2-in-1 account comprising both a trading account and a demat account. If your interest is solely in investing in mutual funds, you can open a 5paisa mutual fund account.

5paisa offers two types of accounts:

A. 2-in-1 Account (Trading + Demat Account)

B. Mutual Fund Investment Account

Steps to create a Demant account on 5paisa

Download the 5paisa application from the Play Store.

After downloading the 5paisa application from the Play Store or the Apple App Store, the next step is to register your phone number in the 5paisa app.

Now, click on the “Continue” button to receive a one-time password (OTP) on your cell phone. 5paisa will automatically verify the OTP that you receive on your cell. Afterwards, you can click on the verify button to proceed to the next step.

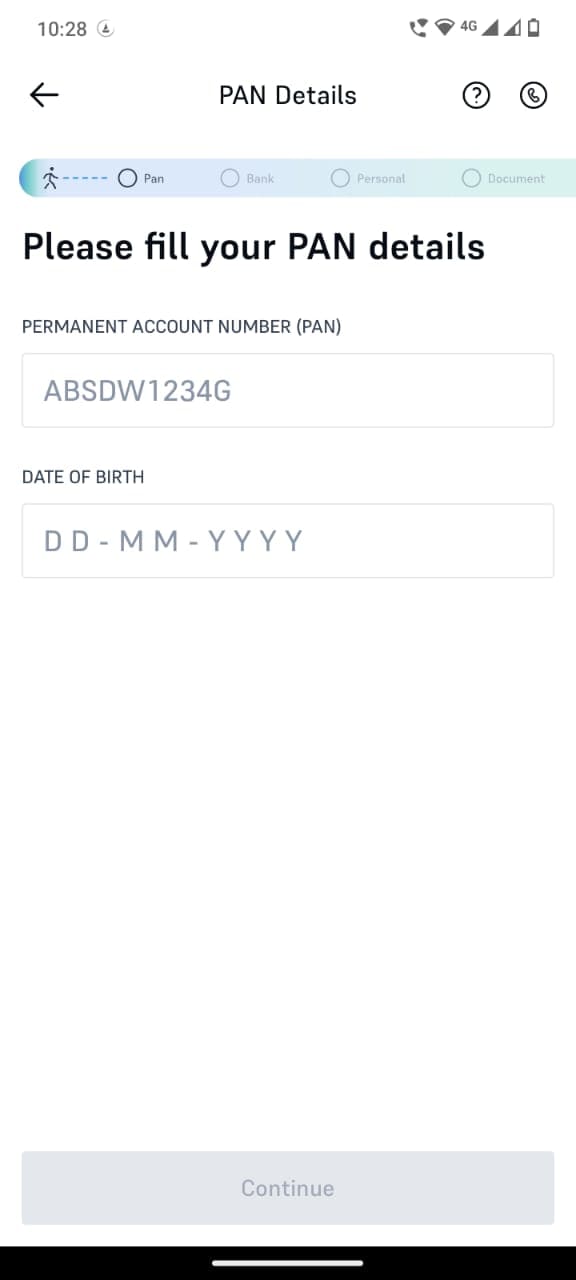

Following the verification process, please enter your PAN details along with your date of birth (DOB).

After entering your PAN card details, the app will automatically retrieve your name. You can then click on the “Continue” button below. For instance, if your name is Mohan, the app will prompt you to confirm both your name and PAN card details.

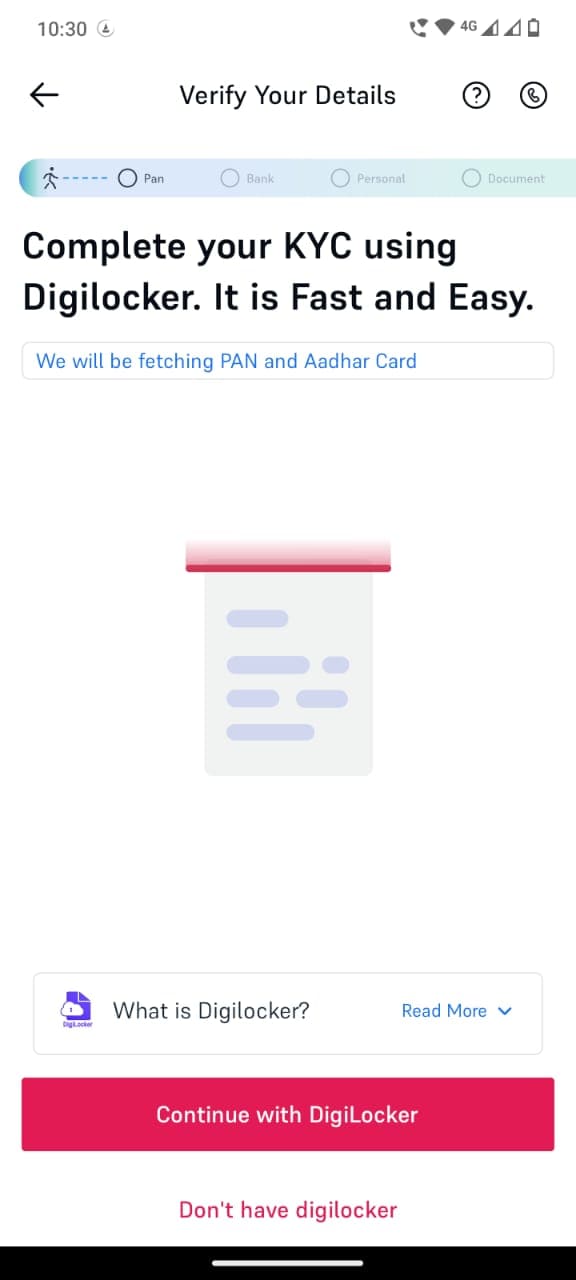

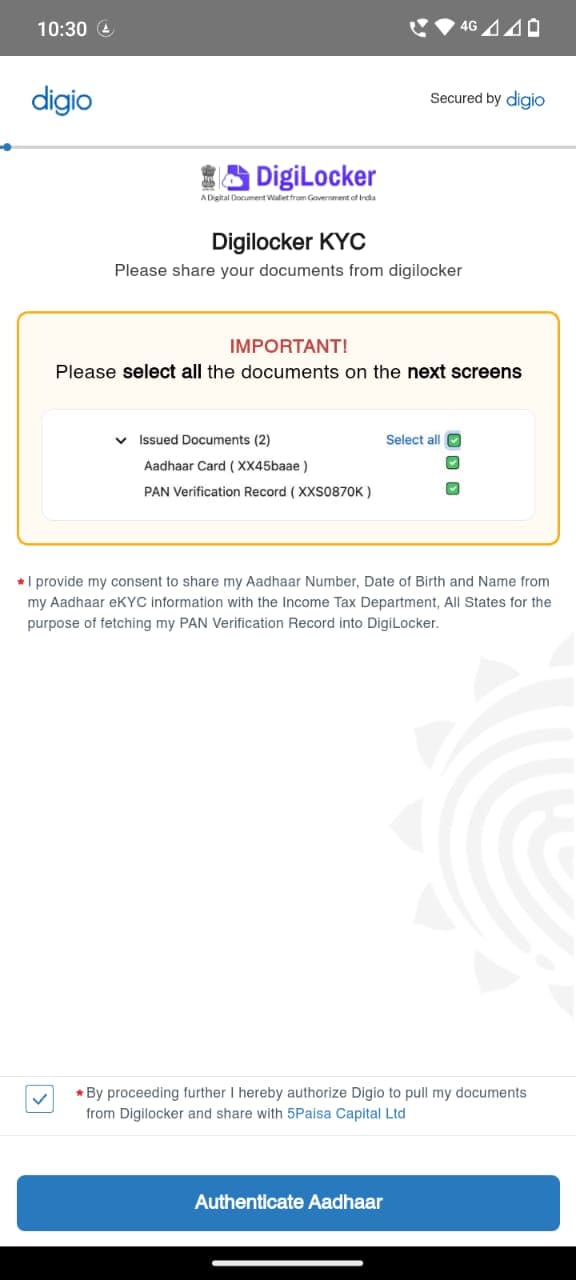

After verifying your PAN card, you must proceed to complete your KYC using Digilocker.

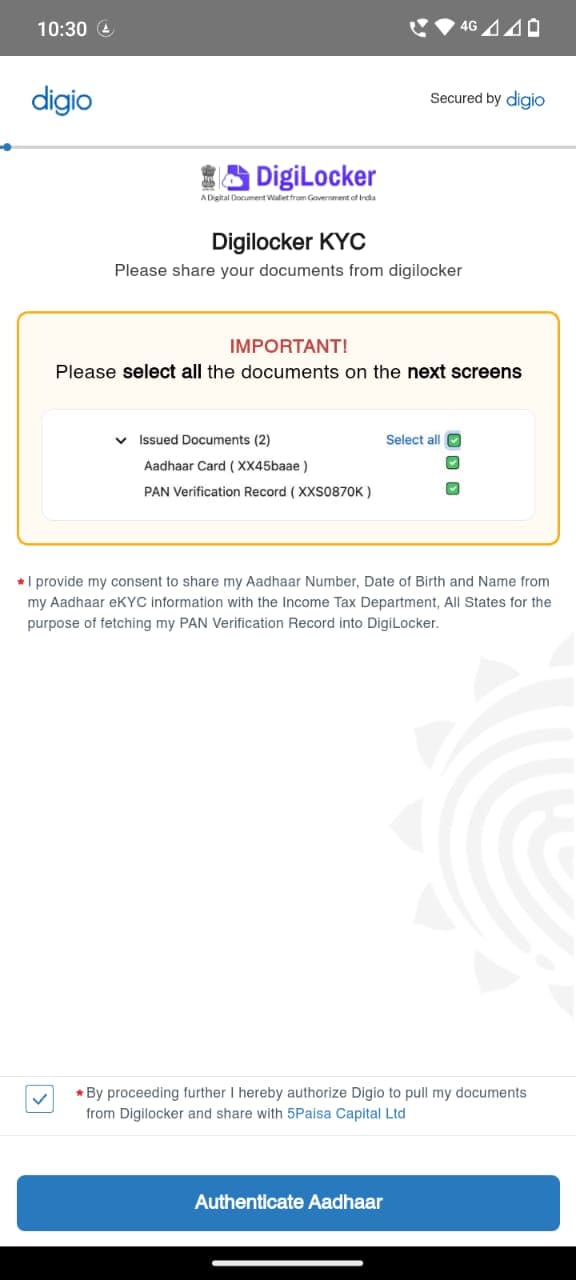

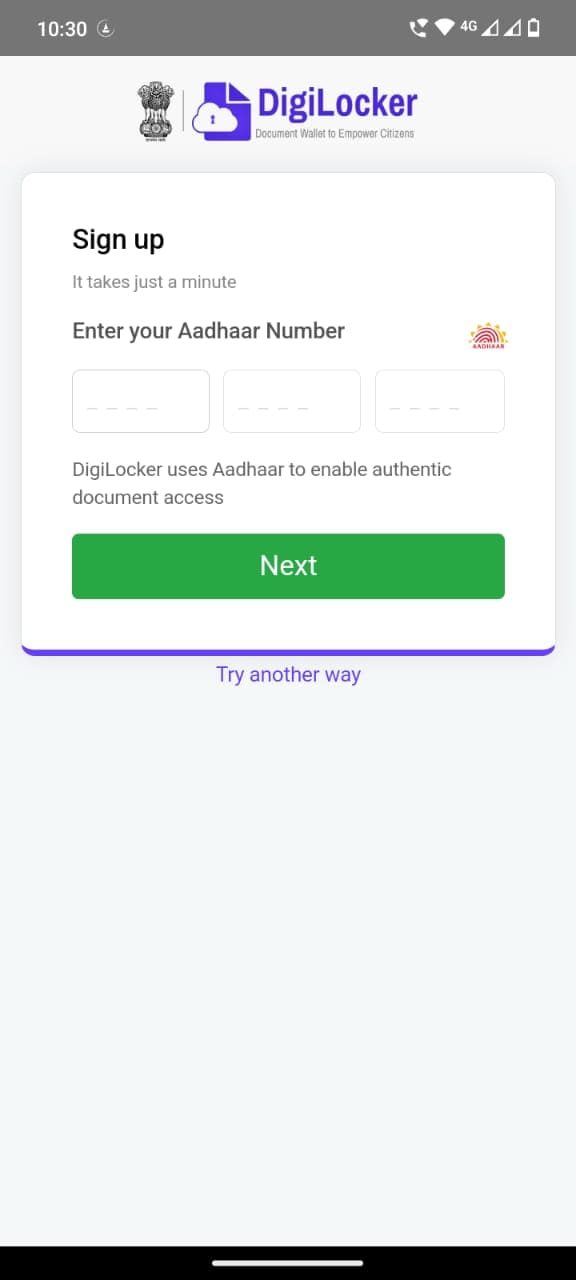

After proceeding with KYC, you will be redirected to the DigiLocker page. There, you need to select the document you want to share with DigiLocker and proceed to authenticate your Aadhar card. DigiLocker is a secure government website designed for the safe uploading of your documents.

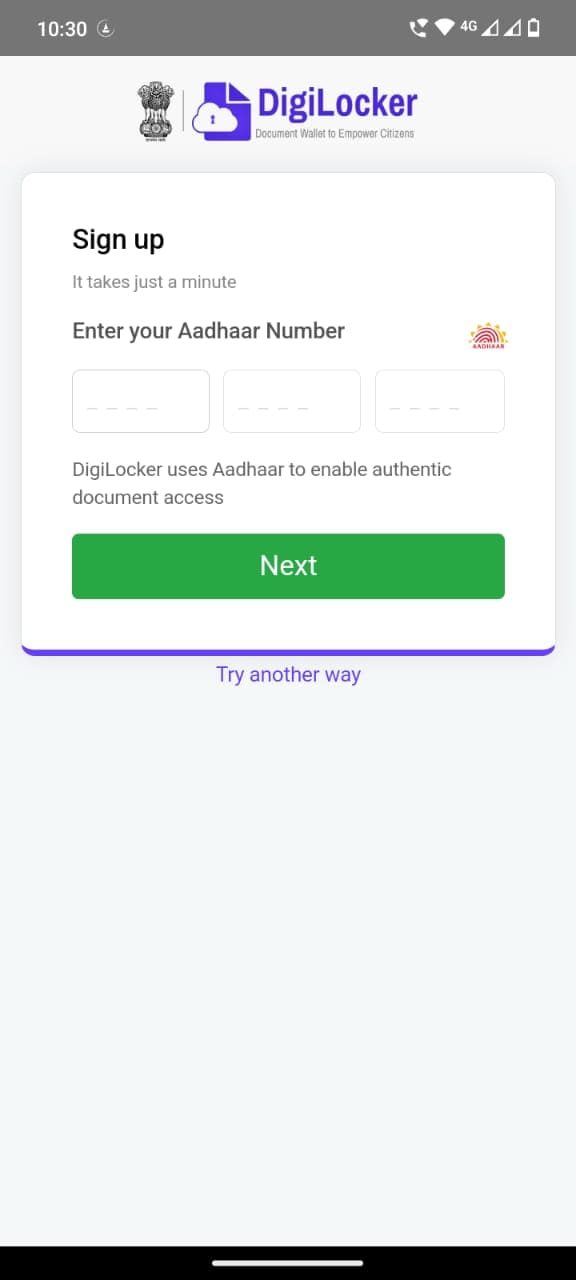

After clicking on authenticate your Aadhar, you need to enter your Aadhar card number and click on next.

In the next step, DigiLocker will be requesting your consent to share the Aadhar card and PAN card. To give consent, you need to click on the ‘Allow’ button.

Now, DigiLocker displays the document you shared with them. In my experience, I provided them with my Aadhar card details. You can also provide them with your PAN card details.

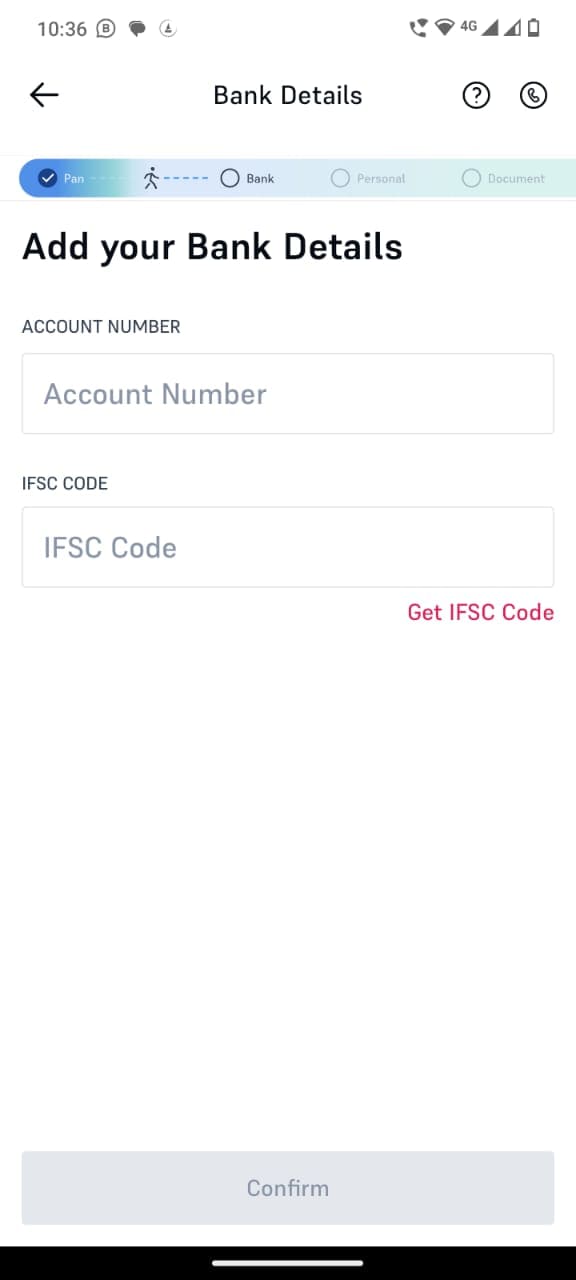

In the next step, please provide your bank details, including your account number and IFSC code.

In the next step, please provide your father’s full name, marital status, and gender. From now on, the main steps to creating your account on the 5paisa app will start. Make sure that you fill in every detail carefully at every step.

In the next step, you need to select your educational qualifications.

Now choose your occupation from the various range of options available to you. If you are the owner of a store or small business, then select Business, or you can select any other option depending on your work profile and the industry in which you are working.

Now you need to choose your source of income. There is no need to worry about sharing your personal income details. This step is only to collect some relevant information from you.

In the next step, you need to select your net worth (annual income) when creating an account on 5paisa. Some people may find this step confusing because 5paisa is asking for monthly income, but you simply need to choose your net worth. Additionally, you can also designate a nominee for your 5paisa account. It’s crucial to add a nominee, so please don’t forget to do so.

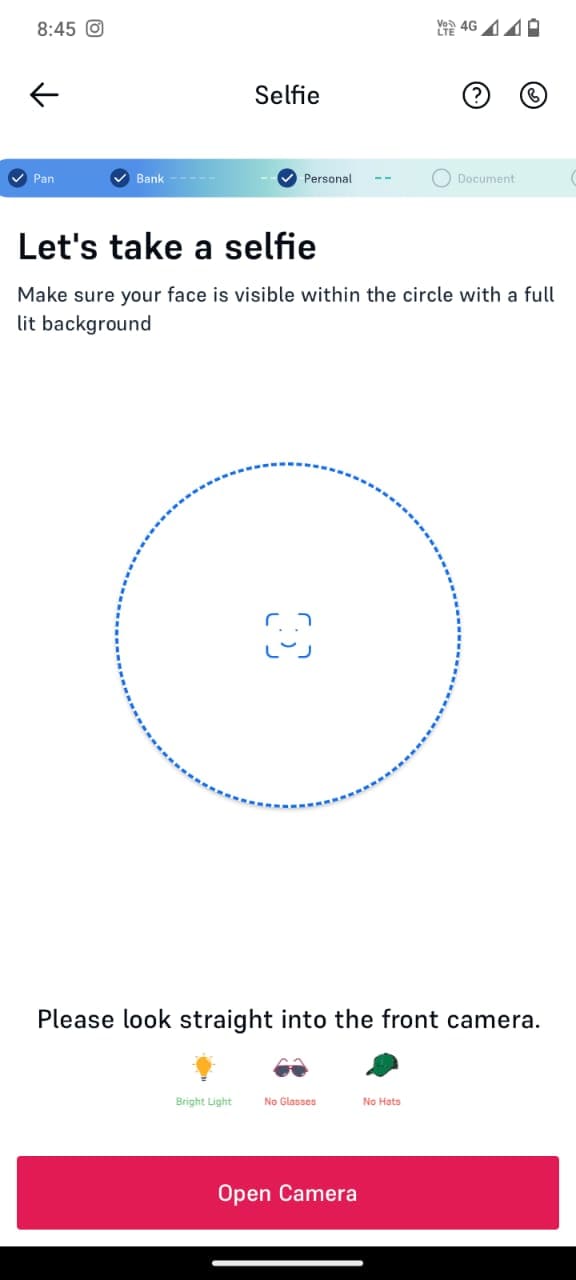

Now, it’s time to take a selfie for verification. Make sure to look straight into the front camera, and ensure your face is visible within the circle against a well-lit background. Please do not wear glasses or a hat during this process.

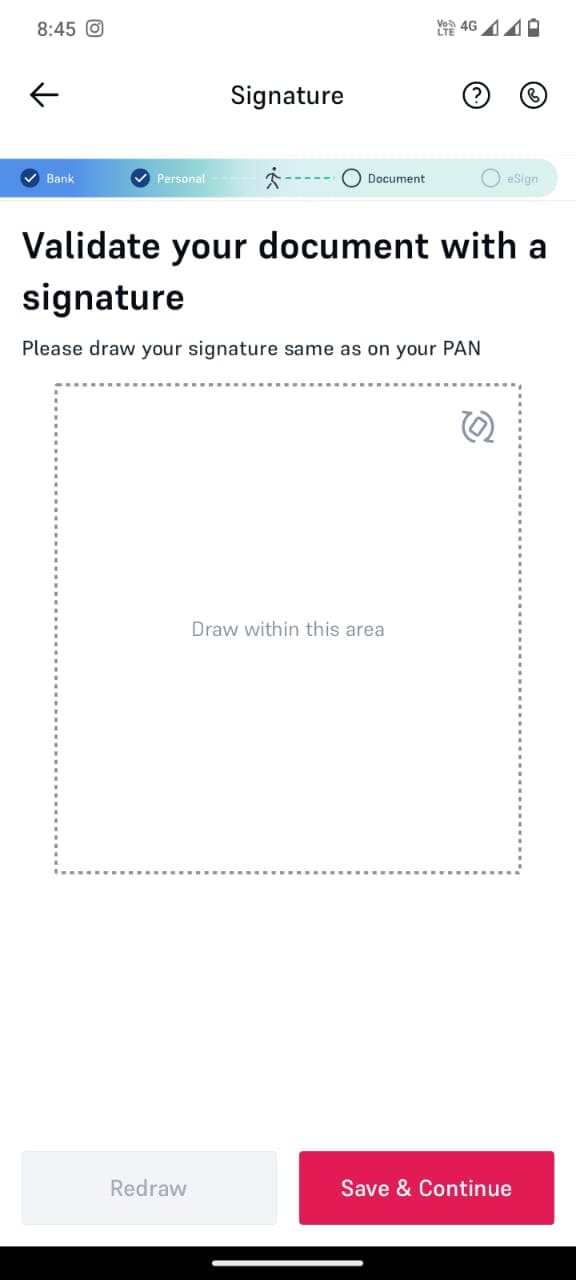

In this step, to validate your document, you need to draw your signature exactly as it appears on your PAN card.

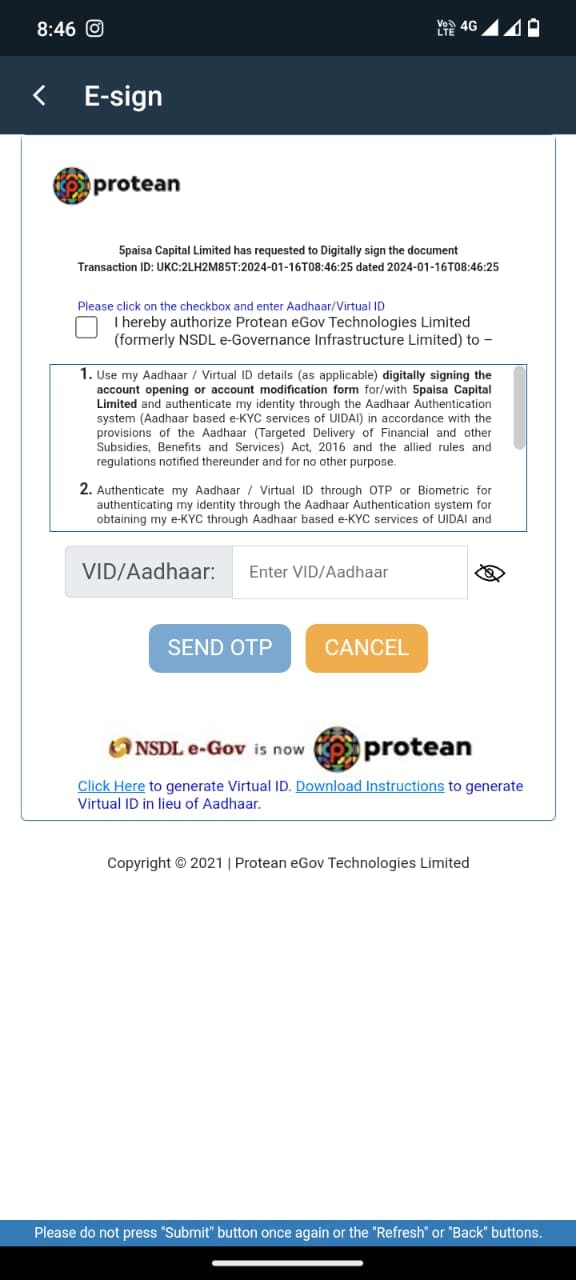

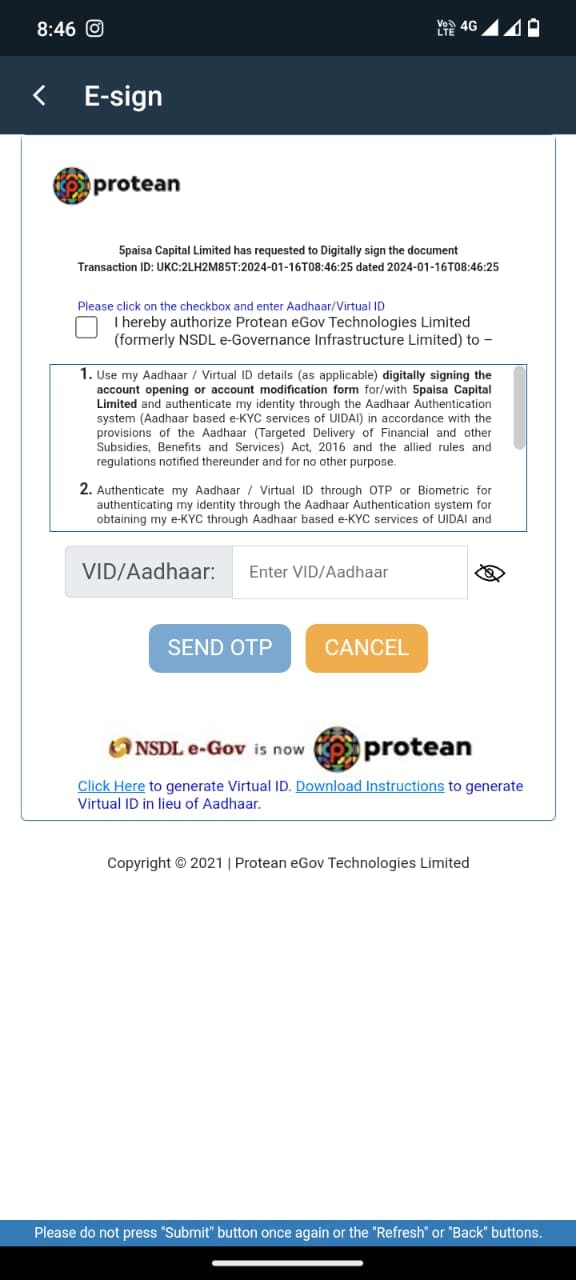

In the next step, you need to sign using Aadhar, and it is the last step to complete your sign-up in 5paisa.

Afterwards, click on “Send OTP.” You will receive an OTP on the number you added to your Aadhaar card, and then enter it in the “VID/Aadhaar” block.

Now that you have completed your E-sign process, simply click the “Continue” button to finalize the registration.

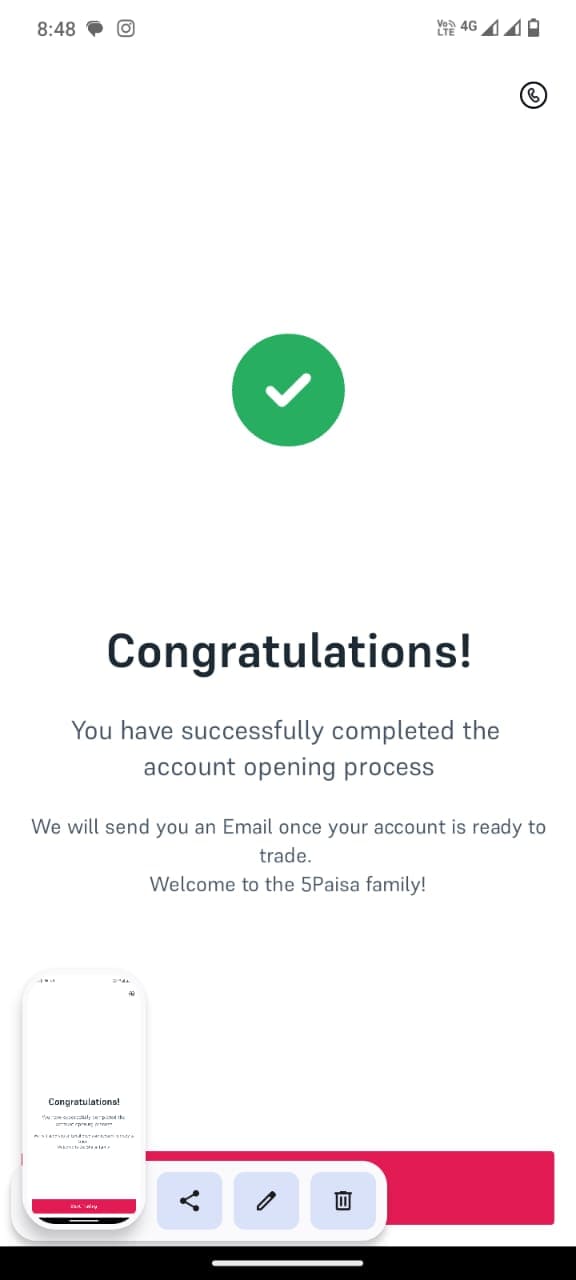

In this step, you have completed the account opening process. 5paisa will send you an email once your account is ready to trade. Normally, it will take 2-3 days or less to receive an account opening confirmation message.

How to Use the 5paisa for Mutual Fund Investment

Now you can grasp how to create an account and complete KYC on 5paisa. Let us now explore how to invest in mutual funds on 5paisa.

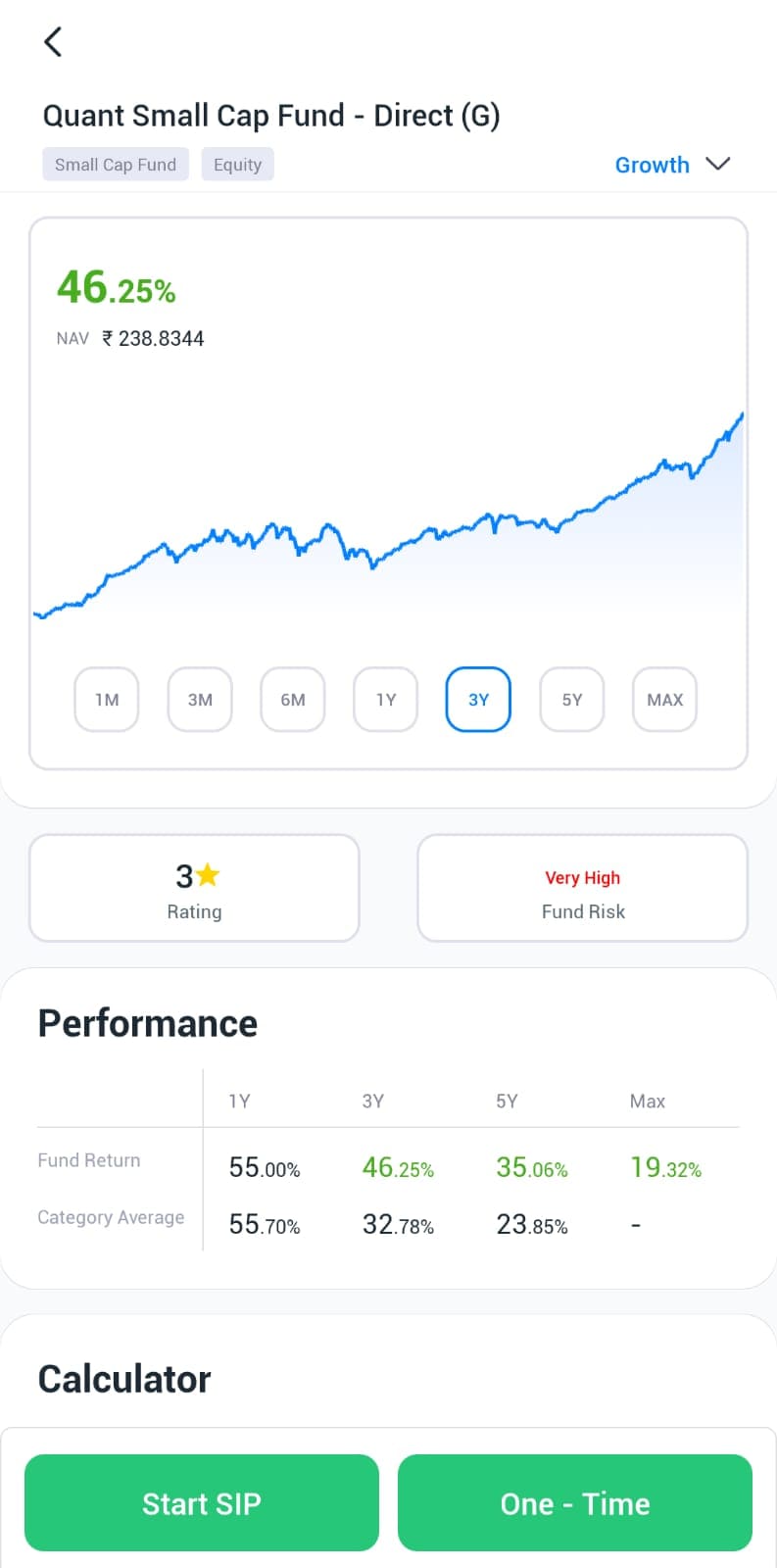

5paisa provides both lumpsum and SIP investment services in mutual funds for its clients. To be honest, the returns on 5paisa mutual funds are excellent for their investors, as they offer various fund categories to invest in mutual funds, and they keep adding new fund offers to the platform.

A 5paisa mutual fund screener is also available so that clients can easily overview various mutual fund houses and choose the best 5paisa mutual fund according to their needs.

The cut-off time for the 5paisa equity fund and debit fund is 3 pm, and for the liquid fund, it is 2 pm. The rates for 5paisa mutual funds are also minimal. Users can download the 5paisa mutual fund statement after logging into their 5paisa mutual fund account.

Here’s how you can initiate both lump sum and SIP investments in a mutual fund through 5paisa:

1) To commence either a lumpsum or SIP investment in a mutual fund through 5paisa, start by logging into your 5paisa account. If you are using the 5paisa app, log in using your user ID (provided by 5paisa).

Subsequently, you will receive an OTP on your registered phone number. After entering the OTP, 5paisa will prompt you for your password PIN. If you are using the web application, log in using your Gmail or phone number, followed by your password PIN.

2) As mentioned earlier, 5paisa offers both lump sum and SIP investment services in mutual funds. Now, let’s understand how you can invest in both types of mutual funds:

A. How can I make lumpsum investments in mutual funds?

A lumpsum investment means investing a specific amount of money in a mutual fund or other financial instrument in a single, one-time payment.

There are several advantages to investing a lumpsum in mutual funds in 5paisa, such as:

Investing a Substantial Sum: This method allows you to invest a significant amount of money in a mutual fund scheme. If the market enters a growth phase, your investment value can skyrocket.

Ideal for Long-Term Investment: Lumpsum investment is ideal for those looking to invest for the long term, such as 10 to 15 years.

Investing Convenience: Investors using this method do not have to worry about investment deadlines or saving enough money each month to invest.

To start your lumpsum investment in mutual funds via the 5Paisa app, follow the steps below:

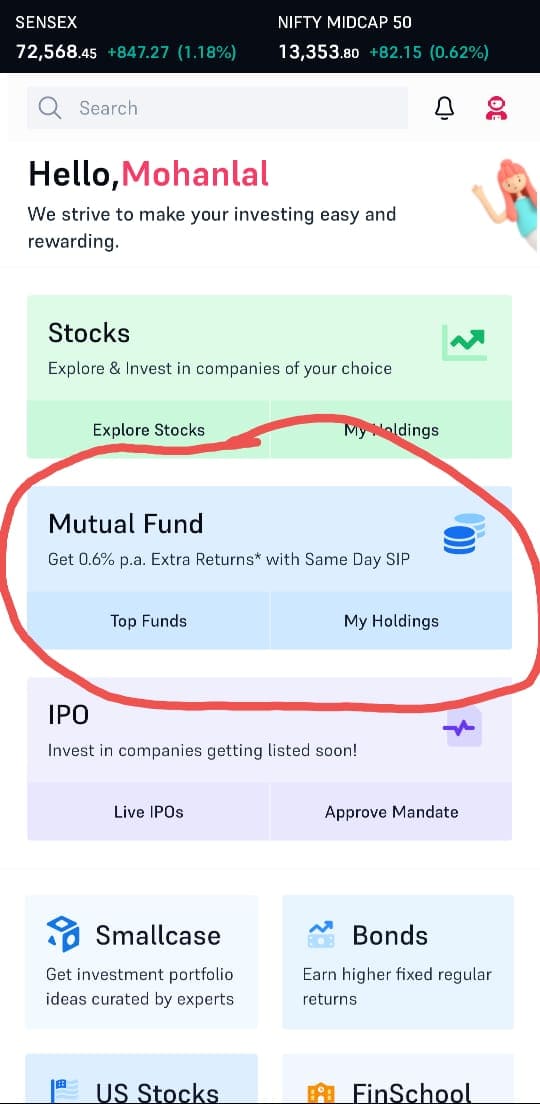

1. Log in to your 5Paisa app account and navigate to the Mutual Funds section.

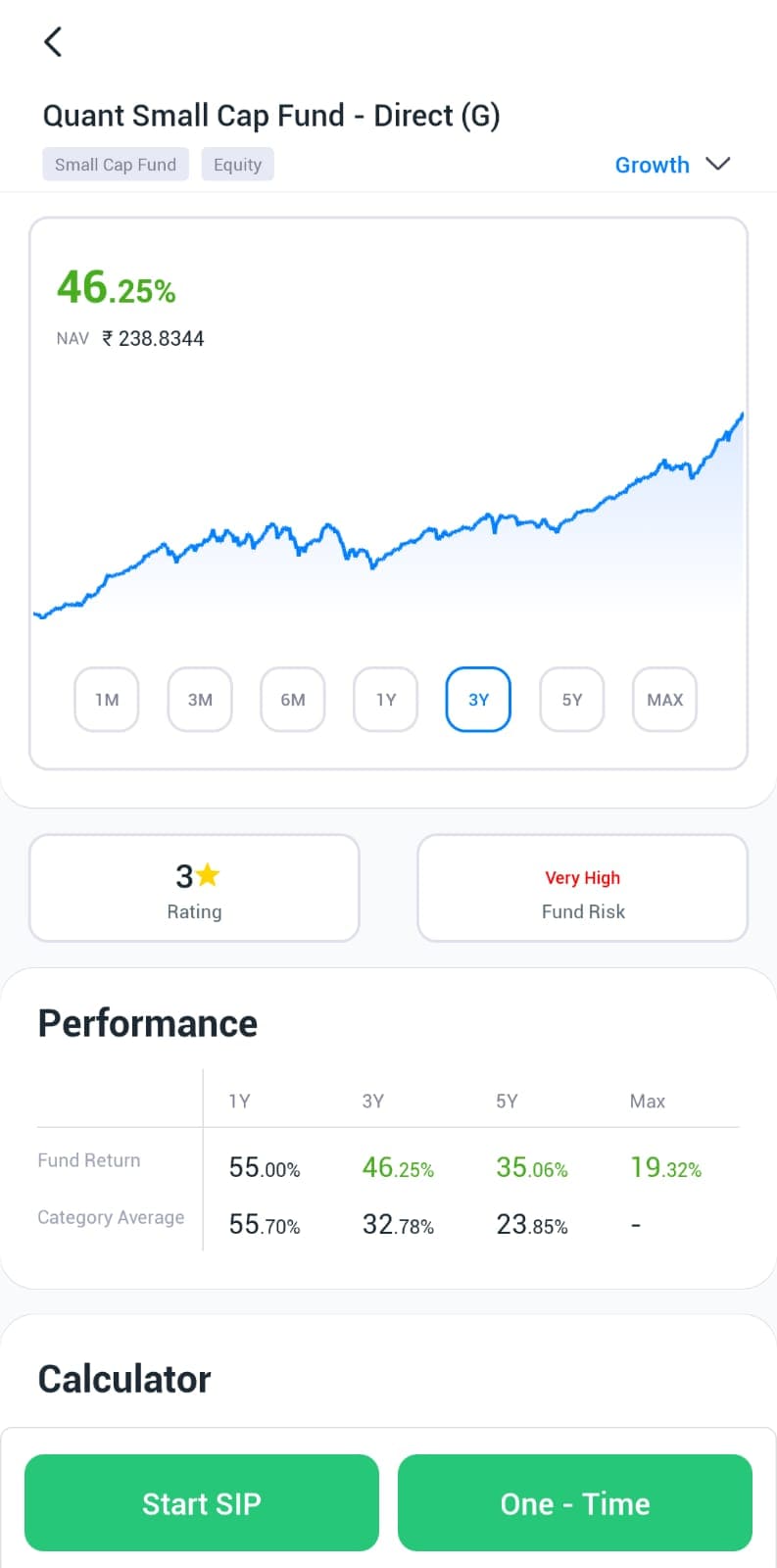

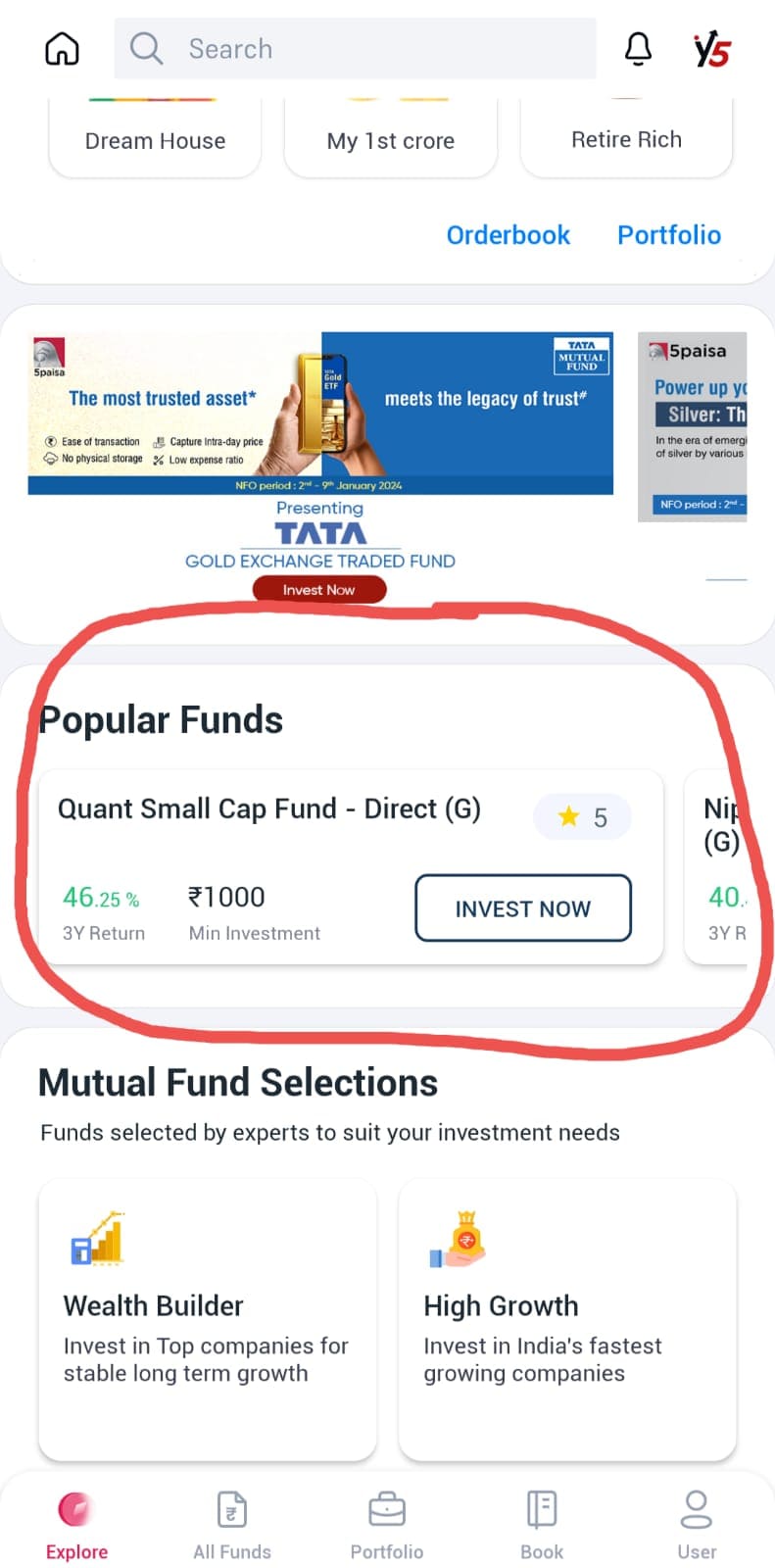

2. Select funds from the Popular Funds section.

3. Click on “On-time.”

4. Add your lumpsum amount.

5. Click on “Invest Now.” Please note that the only available payment mode at this stage is net banking.

6. Click on “Place Order,” and you will be redirected to your bank’s net banking page for payment.

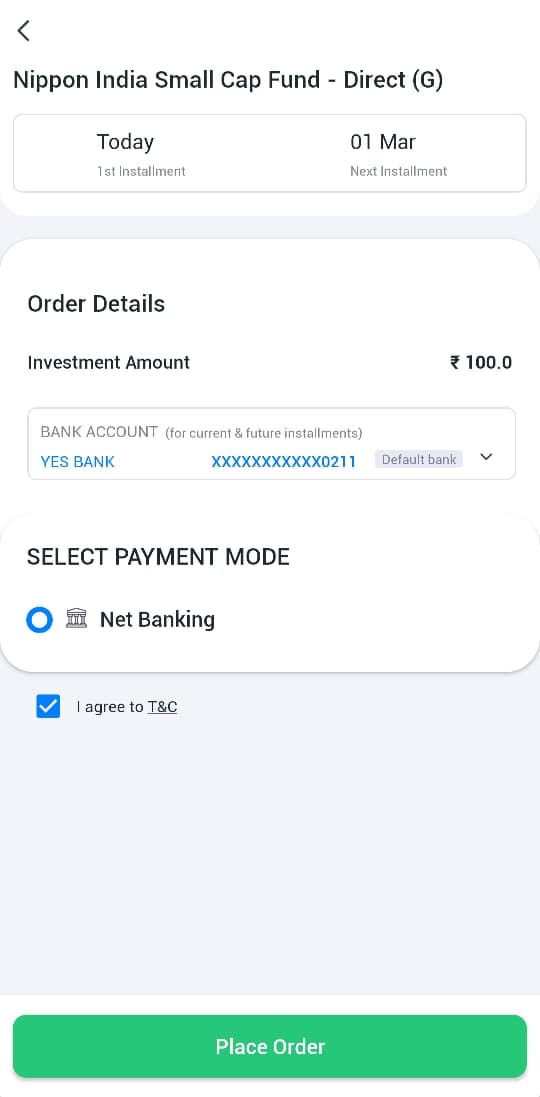

B. How can I start a SIP in mutual funds?

Investment in SIP can be done through the below steps.

1. Log in to your 5Pasa app account and navigate to the Mutual Funds section.

2. Select funds from the Popular Funds section.

3. Click on “Start SIP.”

4. Add your SIP amount, select the date you want the SIP to start, and then hit the “Invest Now” button.

5. Then click on Netbanking.

6. Enter the required details and click on “Confirm & Pay.” Your SIP will be registered.

How to Use the 5paisa for Investment in Shares

Let us now understand how you can easily buy shares via 5paisa.

1. Once you have logged in to 5paisa.com or the 5paisa mobile trading app, you will get a complete overview of all the shares and other investment products on the dashboard.

This dashboard will give you an overview of the market. On the left side of the image, you will see different selections such as watchlist (to keep an eye on your favorite stocks), order & position (your buying or selling stock order), portfolio (your invested stocks), fund ledger (all the account funds-related information), and many more.

You can search for your stocks by using the filter or screener option or by directly typing the name of the stock that you want to invest in.

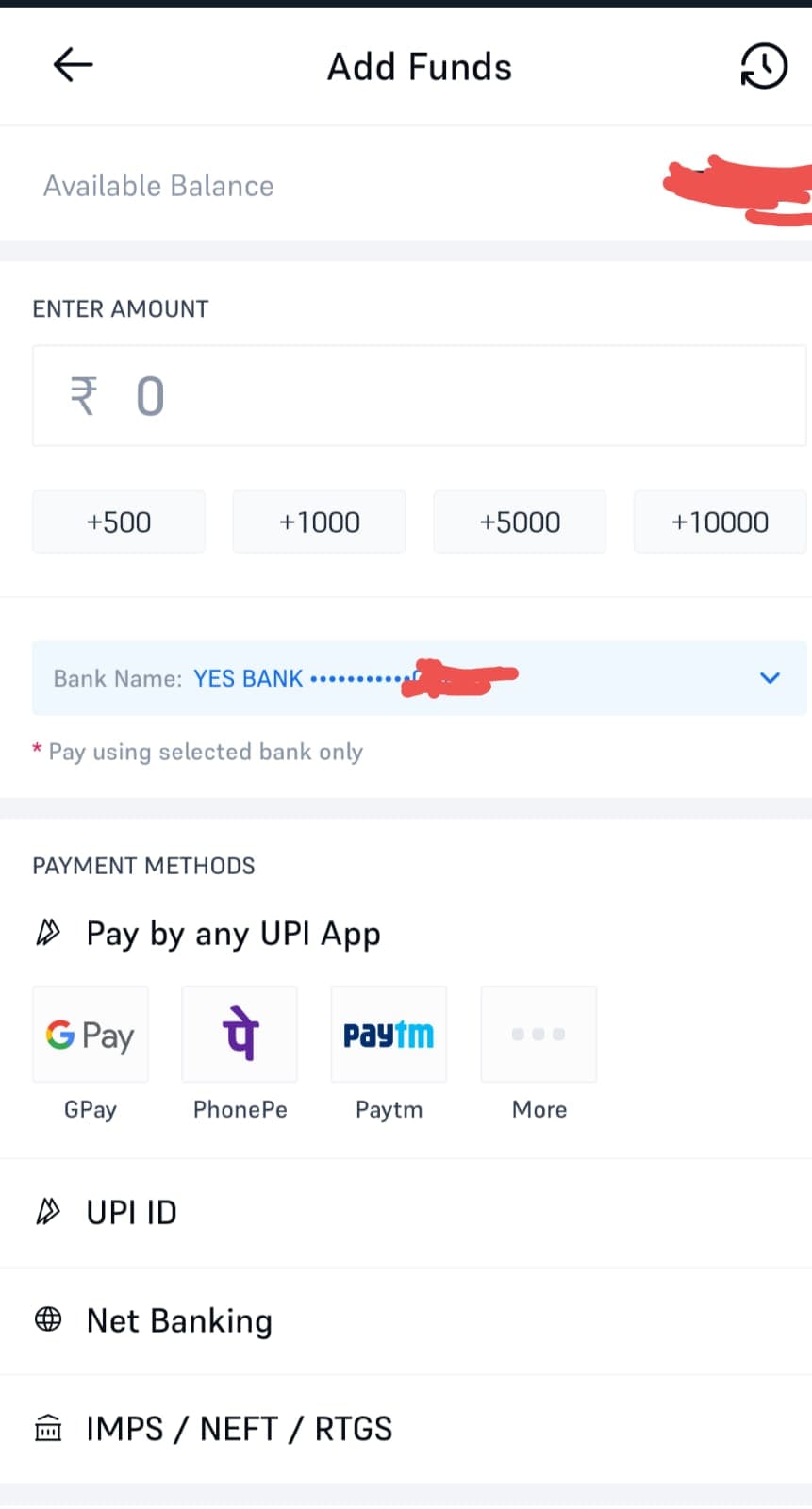

2. Once you have decided which stock to buy, the next step is to add funds. First, you need to go to your user section and click on Add Funds.

Then enter the amount you wish to invest in stocks and select your bank name. In 5paisa, you can use multiple payment methods such as Gpay, Phonepe, Paytm, UPI ID, Net Banking, IMPS, NEFT, RTGS, and more.

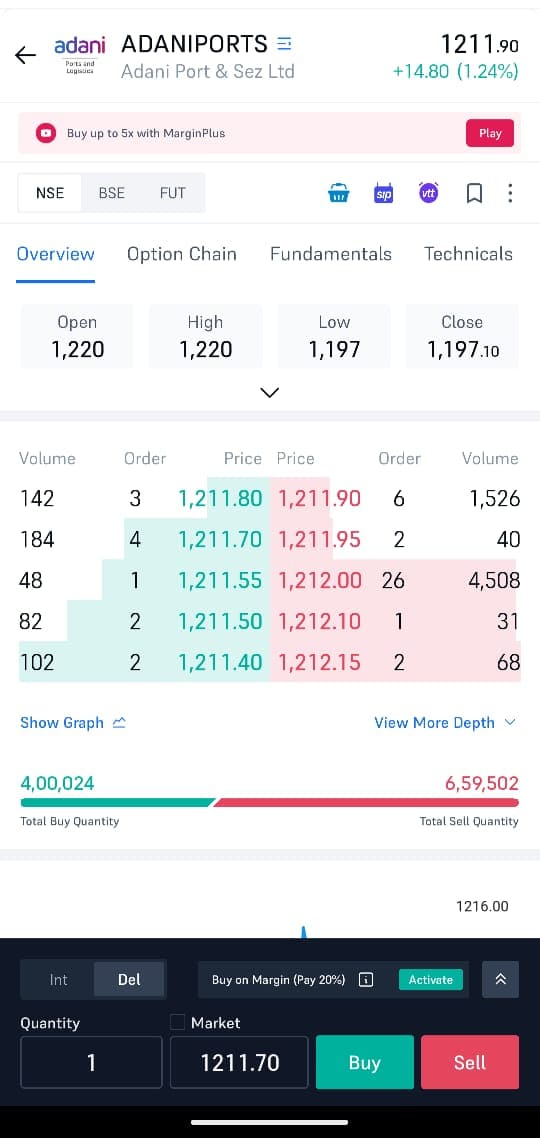

3. Once you have decided which stock to buy, you can decide whether you want to hold it for the long term or trade it. For instance, I selected Adani Port & Sez Ltd.

In Adani Ports & Sez Ltd shares, you will find all the essential information related to Adani port shares, such as open rates, high rates, low rates, and close rates. Also, you will find the volume of the share on just one screen, which sets 5paisa apart from its competitors.

If you want to buy it for the long term, then select “DEL,” which means delivery, and if you select “INT” intraday, then you want to hold it for one day.

4. Now you have to enter the quantity or number of shares you want to buy. You can enter any quantity, and then click on the Buy button.

The moment you hit the Buy button, your buying order will be completed, and you will have ownership of those shares. Your order will be complete in a day, and you can view it in “My Stocks.”

So this is how easily you can use the 5Paisa app for investing in shares.

Is the 5-paisa safe in India?

5paisa is a legitimate and legal investment platform in India, serving as a trusted stockbroker for various reasons. Firstly, it is a publicly traded company listed on the NSE and BSE exchanges. Secondly, the company operates with a zero promoter pledge, signifying that promoters have not pledged their shares for loans. Additionally, 5paisa boasts professional management and is promoted by Mr. Nirmal Jain, the promoter of the IIFL Group.

With millions of active clients, 5paisa stands as one of the leading stockbrokers in India. It initiated its discount brokerage services in 2016 and holds membership in major stock exchanges like BSE, NSE, and MCX. Furthermore, 5paisa actively participates as a depository participant (DP) in CDSL.

As a publicly traded company and stockbroker, 5paisa follows rigorous compliance and audit practices, distinguishing itself from many other unlisted stockbrokers. The company undergoes regular audits by prominent regulatory bodies such as BSE, NSE, MCX, CDSL, and SEBI.

How does the 5paisa work?

5paisa stands out as the best broker in the country, driven by a commitment to prioritize their clients and deliver top-notch services as part of their vision for business.

With this vision, 5Paisa introduced their highly advanced mobile trading app, positioning it as one of the most sophisticated and user-friendly platforms in the market for trading stocks on the go.

5paisa, known as a discount broker, offers a low-cost brokerage service suitable for high-value trading. You only need to pay Rs 10 per trade, irrespective of the trade volume. Additionally, 5Paisa, like other discount brokers, is renowned for providing the best trading platforms in the market.

5paisa is the only publicly listed company in the discount broking space in India.

Services offered by 5paisa:

1. Stock trading and investment

2. Futures and option trading

3. IPO

4. Currency F&O Trading

5. Mutual fund investment

6. US Stocks

FAQs About How to Use the 5paisa App

Download the app, click “Open Demat Account,” complete KYC, and submit the required documents online.

The app provides trading in stocks, commodities, mutual funds, IPOs, and advanced charting tools.

Select the stock, enter quantity or price, and place a buy-sell order through the app’s easy-to-use interface.

Yes, monitor and analyze your portfolio’s performance with real-time updates and detailed insights.

The app employs two-factor authentication, secure socket layer (SSL) encryption, and other robust security protocols.