Overview of Zerodha in India

When we speak about the best investment and trading apps in India, Zerodha comes to mind for most individuals who regularly invest in shares, mutual funds, and securities. Founded by Nikhil and Nitin Kamath, Zerodha is India’s largest stock brokerage firm, with millions of customers and clients. At Zerodha, one can use trading services and invest in mutual funds and many other securities at flat fees and cheap commission rates.

Zerodha leverages technology to serve its customers. They operate in online mode, with fewer offices and branches all over India. This helps them to maintain their profitability and lessen the operational cost of their business. This allows them to cut costs and offer low-cost trading platforms to their customers.

They have multiple product offerings, like Kite, a trading platform, Console: The main dashboard to give an overview of investments and transactions, Coin: for investing in mutual funds; Kite: an API to create trading platforms and systems; Varsity: A learning portal about the stock market, shares, investment, and finance.

These are the main products of Zerodha.

Despite being a successful trading app in India, people still question its safety concerns and policies. So, let’s discuss whether Zerodha is safe or not. Or, whether Zerodha is legal in India or not?

Is Zerodha safe and legal?

Yes, Zerodha is a 100% safe and reliable stock broker firm in India. It is a 100% legitimate online trading app in India and among the low-risk brokerage apps. It is registered with SEBI and a member of NSE and BSE, with all the genuine certifications and licenses to conduct the broking business in India. Whatever transactions you do via Zerodha, all are closely monitored by SEBI and stock exchanges at a regular frequency. In the event of any deviation, they are penalized heavily.

Besides, Zerodha does not do trading itself. So, there is no risk of getting the client’s money used for another purpose. Also, it is a member of the CDSL depository, which makes it more safe and legal to use for trading and investment purposes.

Regulatory compliance by Zerodha

Zerodha is a member of the National Stock Exchange, Bombay Stock Exchange, and Multi Commodity Exchange in India, with its registered office in Karnataka, India. It follows all the procedures, guidelines, and legal protocols laid down by SEBI, RBI, and the Government of India to start a trading business in India.

Over the years, Zerodha has taken several safety measures to protect investors’ interests, clients’ information, and most importantly, their money. At Zerodha, clients’ funds are kept in separate bank accounts rather than the operational bank accounts. This ensures the client’s funds are not used for personal purposes. They have implemented two-factor authentication for long and short transactions, which adds more safety to the transactions done via the Zerodha App.

They have also incorporated SSL certificates on their website and application to win over the customers’ trust for making hassle-free payments and transactions.

While Zerodha has implemented these security measures, it’s important to note that no online platform can guarantee 100% security. Users should also take precautions, such as using strong passwords, keeping their login credentials confidential, and being cautious while accessing their account from public or shared devices.

It’s always a good practice to do your own research and due diligence before using any online trading platform or app. Additionally, consider consulting with financial advisors or professionals to make informed decisions about your investments.

Safety measures by Zerodha

Now let us talk about the safety measures taken by Zerodha.

1. Hosting

First things first, Zerodha’s hosting services and servers are the best in the world, and they follow all the guidelines set by industry standards to secure all the information of their customers. Their hosting comes with SSL certificates on the website and places to prevent eavesdropping. Despite knowing that there is no such thing as perfect security over the internet, Zerodha still makes sure that your data and personal information are kept safe and secured all the time.

Whenever you make any transaction via Zerodha, your data is transmitted between your device and its services using the HTTP protocol and encryption. HTTPS technology is used to create secure web browsers and surfing experiences on the internet.

2. Technology

Technology is another reason why we can justify the fact that Zerodha is 100% safe and secure. For more than seven years now, they have been building technology with a team of expert engineers without depending on external vendors. They have complete control over their technology and data, which makes them safe. On top of that, their technology stack is as per modern standards.

They have also been working on a new security and authentication system to ensure that the Zerodha app and website are safe from the rising cases of phishing and other cybersecurity scams. Also, their platforms have had cryptographic TOTP 2FA support for a while, and we are the only broker to offer this.

The trading platforms that we have developed, incorporating good design, simplicity, and usability, are a major reason for the growth in our client base via word-of-mouth. The products speak for themselves.

3. Authentication

Zerodha follows a two-factor authentication system, which makes their platform safe and sound. This works like a charm and prevents unauthorized access to your Zerodha account.

The scale of their system is also huge, and their app keeps on running 24*7 all day and night. They have not seen any downtime since they launched their application. The top 5 other brokerage apps in India have faced several downtimes and technical glitches. However, this is not the case with Zerodha.

4. Risk management

Zerodha is one of the most conservative brokerage firms in India in terms of leverage. This ensures very little operation risk for businesses. They have a single risk management policy for all their clients and no special deal for anyone else. Thus, the risk management system is lean, and the probability of something going wrong is extremely low. This makes their platform more genuine and less biased.

Since they cater to a large number of retail investors in India, the fear of ultra-HNI clients holding positions is much less with Zerodha. Also, because of their large size, every aspect of their business is regularly audited by all three stock exchanges, depositories, and SEBI as well. What’s more? They don’t have any relationship managers within their internal team with revenue targets. This ensures none of the employees is under pressure to generate brokerage by enticing clients.

They have recently started a new system, Nudge, to deal with all the scammy penny stocks and illiquid option contracts that can potentially lead to scams. Nudge also promotes safe trading by educating investors about the best trading practices to follow.

All these things, put together, make Zerodha one of the safest trading apps in India.

Does SEBI approve Zerodha?

Whenever you are opening a demat account on online trading apps in India, it is most important to know if that app is registered with SEBI or not. Yes, Zerodha is a SEBI-registered app, making it a genuine platform for trading and investment purposes. If you are interested in using Zerodha, make sure that you read all their privacy policies and disclosures beforehand. This mainly includes checking the cost of account maintenance, brokerage charges, commissions, flat fees, and more.

In order to start a trading business in India, every stock broker, trading app, or brokerage firm must get registered with SEBI and have legal status. If any stock broker or trading app is not registered with SEBI, then they are not legally authorized to start a trading business in India. Therefore, Zerodha is registered with SEBI, and you can trade and invest via it effectively, efficiently, and legally.

Is Zerodha approved by the RBI?

Yes, Zerodha is a legitimate stock brokerage firm in India. It is registered with SEBI, CDSL, and all major stock exchanges in India. As with other popular brokers, Zerodha works under the regulations laid down by SEBI and RBI. It is a genuine broker with over 10 years of track record in this business. It has over 12 lakh active customers and contributes to 15% of the total market trading volume.

Features of Zerodha that make them safe

1. Zerodha Kite

Zerodha Kite is their flagship product and feature, which is an online trading platform with market data, advanced charts, stunning UI, and UX. It is universal, and you can search for 90,000+ stocks and F&O contracts across multiple exchanges for trading.

The user interface of Zerodha Kite is kept minimal, with a sleek design for buying, selling, analyzing, and managing your portfolio. Everything can be done with a few clicks. Even if you are using the application for the first time, you won’t feel the heat. To further make your trading easy, you will have access to level 3 data or 20 market depths. Level 3 data will give you deeper insights into the market and stock news and will help you curate successful trading strategies.

The best thing about Zerodha Kite is that it has hundreds of indicators, studies, tools, chart patterns, and a customizable interface with historical data on stocks, futures, and option contracts.

2. Console

Zerodha Console is a centralized dashboard and analytics system that will give you insights on all your trades, investments, and portfolio in general. It will also give you a complete history of stocks from the day of their acquisition. You’ll also be getting tax-ready reports for a full financial year in a ready-to-submit format to your CA.

Besides, the console also crunches tens of billions of rows of historical trade breakdowns to keep track of corporate actions, splits, transfers, and more to compute the most accurate profit and loss statements (P&L) for your portfolio.

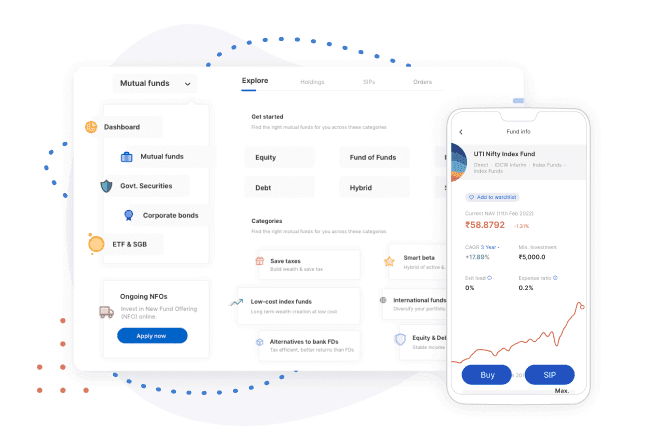

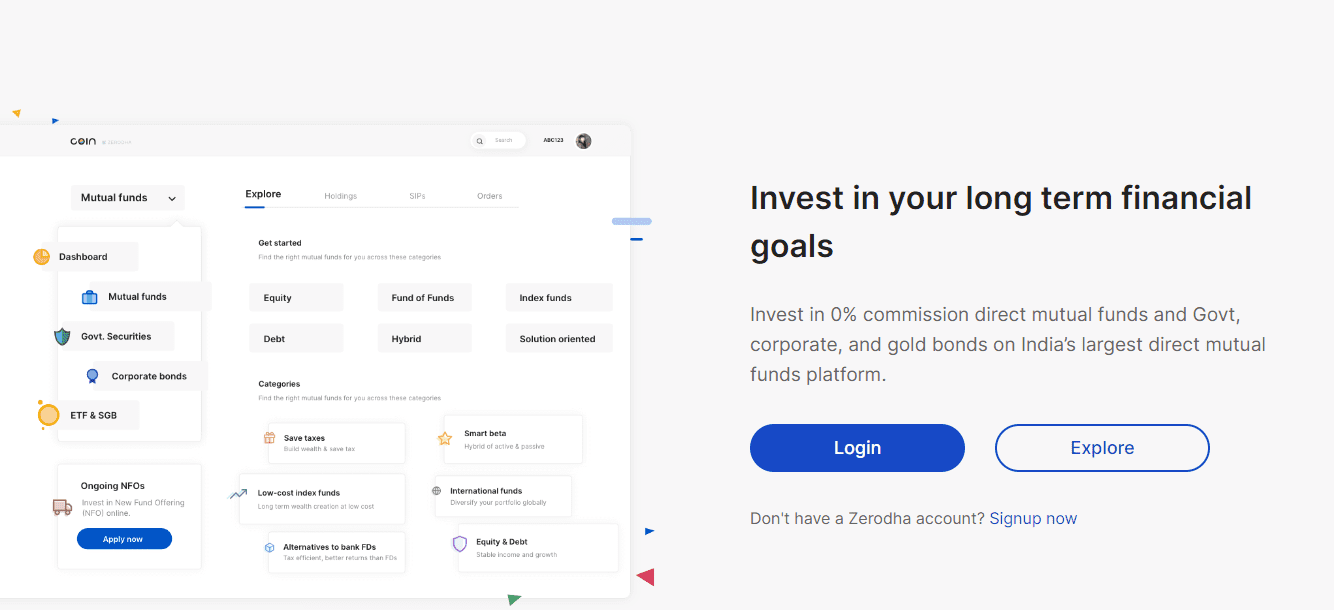

3. Coin

Zerodha Coin is an innovative platform that has revolutionized the way investors buy and sell mutual funds in India. Launched in 2017, Coin provides a commission-free direct mutual fund investment platform. Traditionally, investors had to go through distributors or financial advisors, incurring commissions and fees. Coin eliminates these intermediaries, allowing users to invest directly in a variety of mutual funds across asset classes.

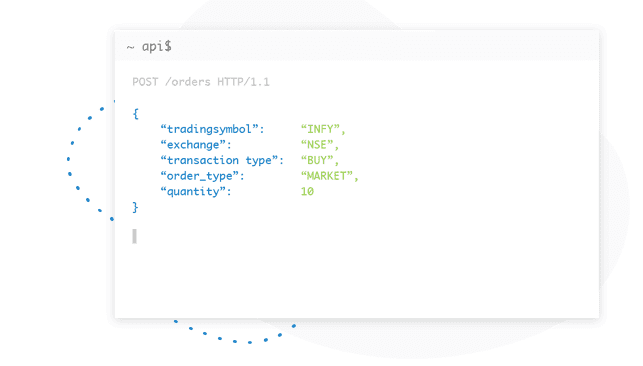

4. API

Zerodha API (Application Programming Interface) is a set of tools and protocols that enable developers to integrate their applications with Zerodha’s trading platform. This API allows third-party developers to create custom trading applications, algorithms, and tools that can interact with Zerodha’s systems. Traders and developers can use the API to access real-time market data, execute trades, and perform various other operations programmatically.

The Zerodha API opens up possibilities for algorithmic trading, automated strategies, and the development of customized trading solutions. This flexibility attracts a community of developers who leverage the API to create innovative tools tailored to their specific trading needs. Zerodha’s commitment to fostering this developer ecosystem reflects its dedication to providing a dynamic and customizable trading experience for its

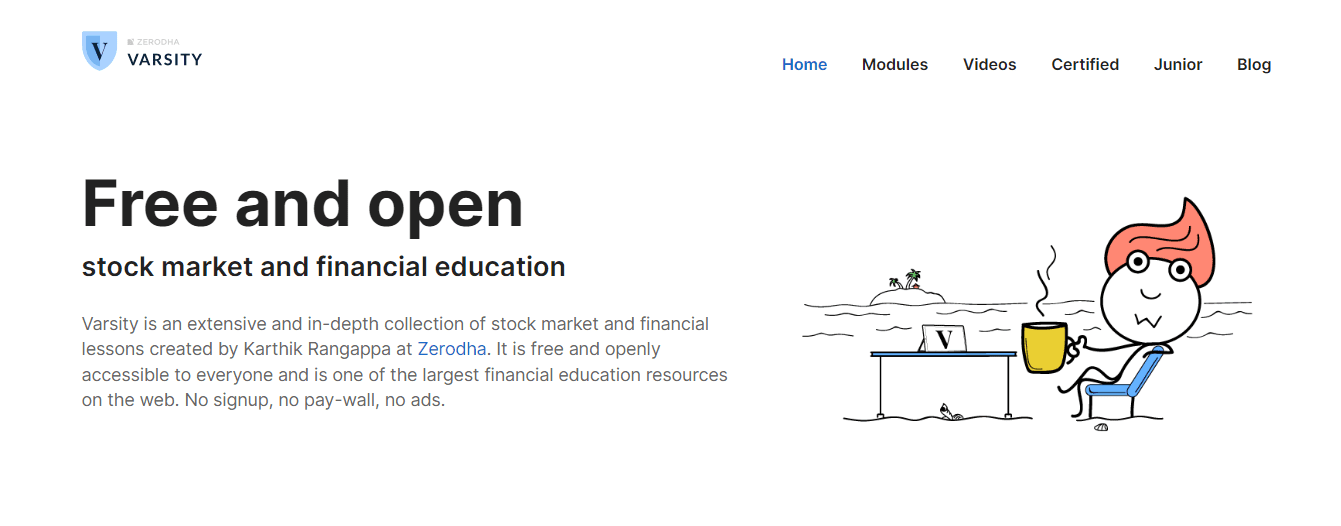

5. Varsity

Zerodha Varsity is an educational initiative by Zerodha aimed at empowering individuals with knowledge about financial markets and trading. It offers a comprehensive set of online courses, articles, and tutorials covering various aspects of trading and investing. Whether someone is a beginner looking to understand the basics or an experienced trader seeking advanced strategies, Varsity provides structured and easy-to-understand content.

The educational content on Zerodha Varsity covers topics such as technical analysis, fundamental analysis, options trading, and more. The platform is designed to be accessible to all, providing a valuable resource for individuals looking to enhance their financial literacy and make informed investment decisions.

Who can use Zerodha?

1. Day traders

Individuals, or day traders, are the first group of people who can use Zerodha for all their day trading needs. This is a trading platform created by Zerodha, especially for those who love day trading in shares, futures, and options. The bandwidth consumption of Zerodha Kite is less than 0.5 kbps, meaning anyone can use it with a simple internet connection via mobile or laptop. It offers extensive charting with more than 100 indicators, loads of chart types, and more.

Currently, this platform is being used by 7 million traders.

2. Mutual fund investors

For those who are not interested in trading, they can use Zerodha Coin, a platform where you can invest in mutual funds, start your first SIP, and invest in corporate bonds and other government securities. The best thing about Zerodha Coin is that it does not charge any commission for investing in mutual funds, bonds, or other securities listed on its platform. However, tax dedication can be done as per the fund management company’s criteria.

3. Long-term investors

The next set of users are long-term investors who can also use the Zerodha Coin for value investing. They can also use the Zerodha Kite platform and hold their portfolio for the long term, for more than 2 or 3 years.

4. Beginners in the investing or finance world

If you are a beginner or newbie in the world of finance, trading, or the stock market, then you can also use Zerodha as a platform to learn and expand your existing knowledge about finance and its other aspects. Zerodha Varsity is a free and open-source learning platform where you can find videos, certification courses, learning material, and blogs related to finance, investment, and the stock market.

FAQs on Is Zerodha Safe?

Yes, Zerodha is 100% safe for trading, investment and for beginners.

Yes, Zerodha is regulated by the Securities and Exchange Board of India (SEBI), ensuring compliance with strict regulatory standards and providing a level of oversight to safeguard investors.

Zerodha employs robust security measures, including encrypted data transmission and two-factor authentication, to protect user accounts and ensure the confidentiality and integrity of trading activities.

Zerodha takes the privacy of user data seriously and follows industry best practices to secure personal information. They have implemented measures to prevent unauthorized access and protect sensitive data.

Zerodha is one of the largest and most reputable brokerage firms in India. It has gained trust in the industry and among users for its transparency, low-cost structure, and commitment to providing reliable trading services.

Zerodha segregates client funds from its own operational funds, ensuring that clients’ money remains safe even in the unlikely event of the company facing financial issues. This segregation protects client funds from being used for company expenses.

Zerodha is known for its transparent fee structure. While there may be nominal charges for certain services, they are clearly communicated, and there are no hidden fees. Users can find detailed information about charges on the Zerodha website.