Are you looking to invest your saved money in the Indian stock market? Do you want to buy shares in listed companies? But you don’t know which application would be great to start your journey. Then, I recommend you choose the 5paisa application, which I have been using for long-term investment in stocks and mutual funds.

If you are wondering what 5paisa is and how it works, then this blog post has got you covered. 5Paisa is undoubtedly India’s top trading and investing app, the only listed application on the NSE and BSE, which sets it apart from its competitors like Zerodha, Groww, Upstox, and many more.

This is going to be an interesting guide post, so make sure to grab a cup of coffee or tea (whichever you prefer), sit back, put your phone on DND so no one can disturb you, and enjoy the blog post to learn more about 5paisa.

What is 5Paisa?

5paisa is a leading online stockbroking company that offers discount brokerage for those who wish to invest in the stock market. It is a publicly traded and professionally managed company, promoted by Mr. Prem Watsa (founder, chairman, and chief executive of Fairfax India Holdings) and Mr. Nirmal Jain (founder of IIFL), who are the major stakeholders.

5paisa offers online trading in equity, commodities, and currency on BSE, NSE, and MCX. It operates as a flat-rate discount stockbroker.

Among the rare discount brokers in India, 5paisa offers trading for a flat fee of just Rs. 10 per trade.

5paisa offers three subscription plans for retail investors: the Regular Account Pack, the Power Investor Pack, and the Ultra Trader Pack. These plans offer various benefits, ranging from zero account opening charges to reducing the flat fee from Rs. 20 to Rs. 10.

There are also 5paisa Mutual Funds, which offer both regular and direct mutual funds. For mutual funds, it charges a flat fee of Rs 10 per executed order for online mutual fund investment. Investors can choose to invest either in a lump sum or through an SIP.

Users can also open their demat account through 5paisa’s depository participant membership with CDSL. CDSL awarded it the status of Premier Depository Participant in March 2019.

The 5paisa trading platform comprises a mobile trading app, a trading website, and an installable trading terminal. These platforms, recognized for their excellent utilization of mobile technology in financial services, are built using the latest technology.

5paisa Plans, Fees, and Charges?

5paisa charges Rs20 brokerage for all stock delivery.

For trading, 5paisa offers three plans: regular, power investor, and ultra-trader.

5paisa brokerage charges for all three plans are as follows:

Transaction | Regular Plan | Power Investor | Ultra Trader |

Stock Delivery | Rs. 20 per order | Rs. 10 per order | Free |

Stock Intraday Trading | Rs. 20 per order | Rs. 10 per order | Rs. 10 per order |

Stock Futures & Options | Rs. 20 per order | Rs. 10 per order | Rs. 10 per order |

Currency F&O Trades | Rs. 20 per order | Rs. 10 per order | Rs. 10 per order |

5paisa plan charges

Regular Plan: The Regular Plan charges a flat fee of Rs. 20 for all trading segments.

Power Investor Plan: Among 5paisa’s different plans, the Power Investor plan is the most popular and highly purchased. The subscription fee for Power Investor is Rs. 599 per month, with a flat brokerage fee of Rs. 10 for all trading segments. Additionally, this plan provides the following benefits:

A. It provides stock ideas for intraday and short-term trading.

B. It includes the Advanced Portfolio Analyzer.

C. It offers research on 4000+ companies.

Ultra Trader Plans: The monthly fee for this plan starts at Rs. 1199. This plan offers various benefits to users, such as:

A. Equity delivery incurs no fee.

B. A flat fee of Rs. 10 per order (50% discount) is charged from the 101st trade onwards for all other segments.

C. The first 100 trades are free every month.

D. There are no charges for fund transfers.

F. There are no charges for calls and trades (a charge of Rs. 100 is applicable for normal clients).

5paisa Account Types

5paisa offers various types of accounts to meet the different needs of users. Below, you will find a brief introduction to each account:

1. Demant Account

2. Trading Account

3. Mutual Funds Account

4. YoungVestor Account

5. PlusOne Account

1. 5paisa Demant Account

5paisa allows you to open a free Demat account through www.5paisa.com or the 5paisa Trading App. It is an electronic account used for holding and transacting securities (stocks, MFs, ETFs, IPOs, GSECs, bonds, etc.) in electronic or dematerialized form. Through this Demat account, you can easily transfer your securities from one Demat account to another. The 5paisa Demat account is suitable for all kinds of users, including individuals, companies, partnerships, trusts, HUFs, or LLPs (Limited Liability Partnerships).

2. 5paisa Trading Account

5paisa trading account facilitates stock buying, selling, money transfers, and more. They act as a crucial bridge between investors and the stock exchange. In the stock market, these accounts are linked to demat accounts, allowing seamless fund transfers between individuals.

5paisa offers three simple brokerage plans for trading accounts: Optimum, Platinum, and Titanium.

Optimum Plan: Trade across various segments for a flat fee of Rs. 20 per order. The Optimum plan monthly charges are none.

Platinum Plan: Enjoy a flat fee of Rs. 10 per order for all your trading needs. The Platinum plan monthly charges are 499 rupees.

Titanium Plan: Trade equities for free—that’s right, no charges for buying or selling stocks. The Titanium plan monthly charges are 999 rupees.

3. 5paisa Mutual Funds Account

Opening a mutual fund account on 5paisa online can be a good move for both retail and large investors. You can easily open a mutual fund account on 5paisa.

5paisa offers two investment plans: systematic investment plans (SIPs) and lump sum investments. They also provide various mutual fund schemes across different categories, such as equity, hybrid, and debt, in small-cap, mid-cap, and large-cap options.

4. 5paisa YoungVestor Account

The YoungVestor account is designed for young individuals eager to invest in the stock market at a young age. Any individual aged between 18 and 23 years old can apply for it and gain access to the stock market trading platform.

5. 5paisa PlusOne Account

The 5paisa PlusOne Account is a special account designed for married couples. You can easily open a PlusOne account on the 5paisa website or application. In this account, you will receive a 50% discount on the brokerage fee, which is a flat fee of Rs 10 per order. Moreover, you don’t have to pay any commission when you invest in mutual funds, providing you with an additional income of 1-2% every year.

Feature and Product of 5paisa

1. Smart Investor

If you are a beginner and want to receive stock investment ideas, you can consider purchasing “Smart Investor” from 5paisa for Rs. 499+GST monthly, providing you with top-quality research on 4000+ stocks.

The Features of a Smart Investor:

A. Model Portfolio:

The Model Portfolio comprises stocks hand-picked by 5paisa’s dedicated research and analyst team.

B. Idea List:

The Idea List features top-performing stocks categorized into different buckets.

The prime list among them is the Growth 50, consisting of stocks that are empirically tested and have strong fundamentals and sound base patterns.

C. CANSLIM Approach:

The CANSLIM Approach offers daily and weekly analyses of the Indian stock market, providing insights on whether the current market is favorable for investment or not.

Make informed investment decisions with the comprehensive features of Smart Investor from 5Pasa.

2. Smallcase

Smallcase is a modern investment product that enables investors to easily construct a low-budget, long-term, and diversified portfolio.

A small case comprises stocks or ETFs that embody an idea, grounded in a theme, strategy, or objective.

Utilizing small cases aids in reducing risk through diversification across numerous stocks, providing complete ownership of the portfolio. This differs from mutual funds, where fund units are obtained. Additionally, the investment amount can be easily adjusted, and small cases can be sold either in full or partially at your discretion.

Smallcase portfolios are built using a rules-based approach. This means that each portfolio’s stock list is selected based on specific criteria, such as a company’s financial health, growth potential, or position in a particular sector.

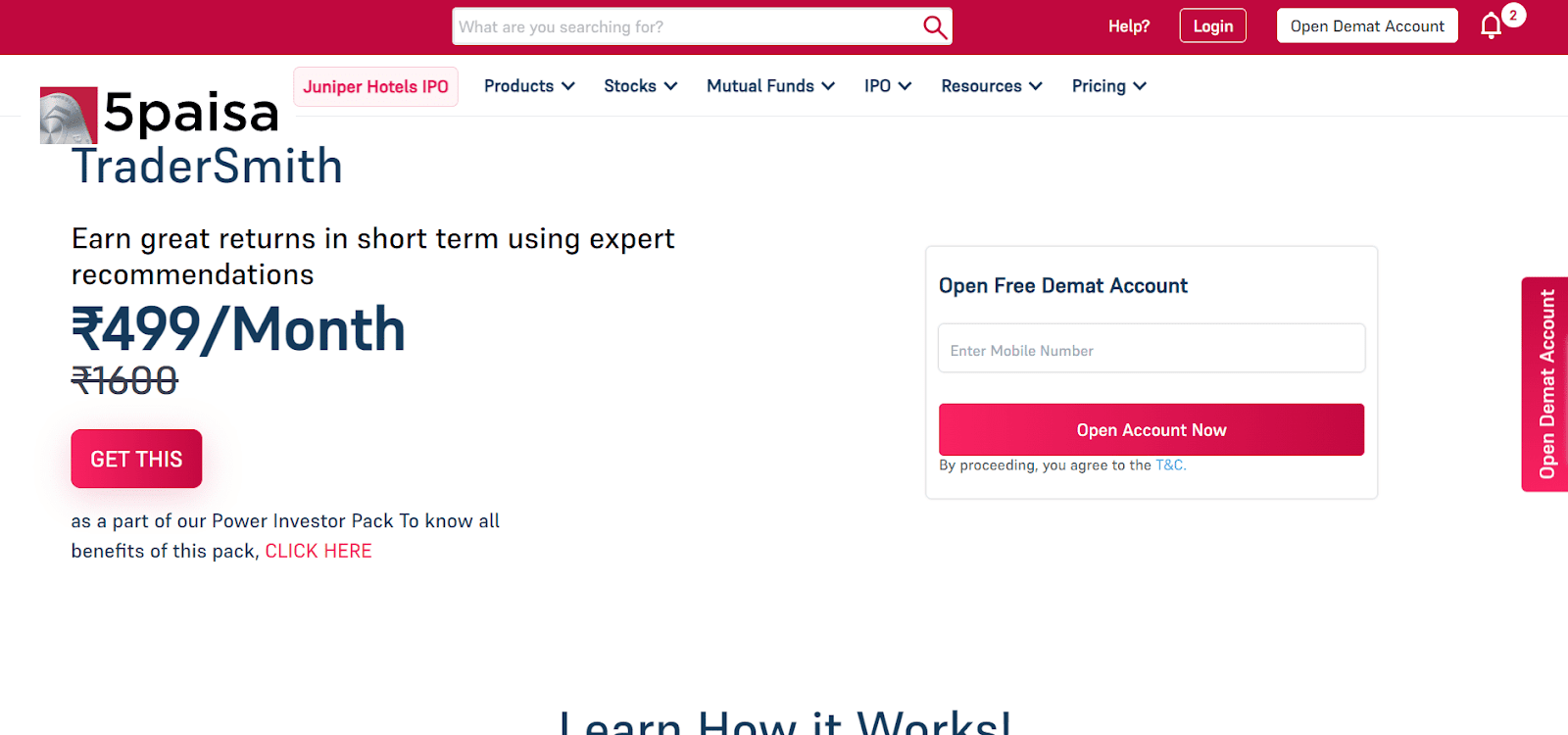

3. Swing Trader

The swing trader is an equity research tool that provides short-term trading calls. After studying the market thoroughly, the swing trader offers 5-8 trading calls, which can help you achieve a 3-4% return per month.

Swing Trader, or TraderSmith, focuses on short-term trading ideas (1 day to 1 week) using fundamental and technical analysis.

With this tool, you’ll receive short-term recommendations, timely notifications for buying and selling, and regular market analysis.

Short-term traders can leverage these features to boost their chances of success.

5paisa Trading Platforms

5paisa offers the best trading platforms in the Indian stock market for its web-based clients, as well as Android and Apple-based clients. Moreover, 5paisa has made a significant investment in its online trading platform to provide its clients with an excellent user experience while trading.

5paisa provides a wide range of trading platforms and tools to its customers at no cost. The various trading platforms and tools offered by the company include:

A. 5paisa Mobile Trading App

B. 5paisa Trade Station EXE (Desktop Trading Platform)

C. 5paisa Trade Station Web (browser-based platform)

D. 5paisa Algo Trading (Automated Trading Tool)

E. 5paisa Robo Advisory (Mutual Fund Selector)

1. 5paisa Mobile Trading App:

The 5paisa mobile trading app is one of the best Indian mobile trading apps, serving as an all-in-one app for trading. More than 1 crore people have downloaded this app, and over 40 lakh users are actively using it.

If you are a beginner or new to the stock market, the 5paisa mobile app is a good option for you. The app’s functions are easily accessible, providing a great user experience with excellent customer support.

This application is available for Android and Apple smartphones, offering a wide range of features to analyze stocks.

Various key features available on the 5paisa app include:

A. One-touch login via fingerprint

B. Customizable Watchlist and Ticker

C. Multilingual Support (Support in 8 Languages: English, Hindi, Marathi, Gujarati, Bengali, Kannada, Tamil, and Telugu)

D. User-friendly mobile app design

E. Trade and invest across stocks, mutual funds, IPOs, currencies, commodities, etc.

F. Easily access research and advisory services inside the app.

G. Get live updates on stock prices and quotes.

H. Automate stock orders.

I. Robo Investment Advisor

J. Instant fund transfer via UPI and net banking.

2. 5paisa Trade Station Web (browser-based platform)

5paisa Trade Station is an online, web-based trading platform available for PC, laptop, smartphone, or tablet. It has a user-friendly trading interface that is also suitable for beginners. You can use the 5paisa web interface with Firefox, Chrome, and Safari browsers. It offers a wide range of features, such as:

A. Access the NSE and BSE for trading in equity, derivatives, and currency.

B. Access a variety of reports for analysis.

C. Track your investment portfolio comprehensively.

E. Keep an eye on your chosen stocks with a market watchlist.

F. Implement order slicing for improved pricing.

G. Leverage bracket orders (BO) and cover orders (CO) for strategic trading.

H. Facilitate fund transfers seamlessly.

I. View your positions and holdings across various instruments in one consolidated display.

J. Utilize advanced charting tools for a detailed analysis of stocks.

K. Access detailed data on stocks, including market depth and the option chain.

3. 5paisa Trade Station EXE (Desktop Trading Platform)

The 5paisa Trade Station is a downloadable trading terminal developed by 5paisa, ideally suited for frequent traders who require advanced trading tools for their trades. Traders can download this trade station EXE onto their desktop or laptop. This application offers real-time data and advanced charts for intraday trading and comparing past stock prices.

The 5paisa Trade Station EXE offers a wide range of features, including:

A. Providing a high-speed desktop or laptop-based trading platform.

B. Offering personalized watchlists to monitor favorite stocks and contracts.

C. Enabling the use of shortcut keys for faster trading.

D. Providing a quick fund transfer facility.

E. Offering advanced charting features for effortless stock analysis.

F. Including bracket orders and cover orders.

G. Featuring an Order Slicing feature for obtaining better prices.

How to download 5Pasa Station EXE

Step 1: You need to go to the 5paisa.com official website.

Step 2: Click on ‘Product’ on the top menu, and then click on ‘Technology’.

Step 3: Click on ‘TRADE STATION EXE’ on the list of platforms.

Step 4: Click on ‘DOWNLOAD THE EXE’ to download 5paisa Trade Station.

4. 5paisa Algo Trading (Automated Trading Tool)

5paisa Algo Trading is an advanced tool that automatically executes your trading orders based on predefined parameters such as time, price, and volume. It has various features, such as:

A. Generate, backtest, and implement your algorithms.

B. Get API documentation for hands-on strategy coding.

C. A real-like simulation environment for strategy testing

D. Access preloaded algorithms such as Amibroker, Jobbing, Pivot, Buy/Sell Call Execution, Bulk Buy/Sell, and Paired Spread Trading Strategies.

E. Receive expert support for coding your strategies.

F. Guidance in obtaining exchange approval for your strategies

G. Effortlessly integrate strategies with the trading platform.

How to Open an Account with 5paisa

The account opening process with 5paisa is much easier compared to its competitors. It is entirely online and paperless, taking approximately 5 to 10 minutes to complete the documentation.

Here is a step-by-step guide:

1. Visit the 5paisa website or application.

2. Provide your phone number for registration.

3. Enter the 4-digit OTP sent to your mobile number.

4. After adding your mobile number, proceed to add PAN card details with your date of birth for verification.

5. Continue the KYC process by using Digilocker, a government-authorized portal, to fetch your documents.

6. Enter your Aadhar card number to continue with Digilocker and verify with OTP.

7. In the next step, add your bank details, including your bank account number and IFSC code, and then click on the “verify” option.

8. Add your personal details, including your father’s full name, marital status, gender, educational qualification, occupation, experience, and net worth, then click on the “submit” option.

9. Now, take a selfie for verification. (Tip: Ensure your face is straight and visible within the circle with a well-lit background.).

10. Validate your document in this step by drawing your signature and pressing the “Save & Continue” button.

11. In the last step, click on the “Esign now” option, add your Aadhar number, enter the OTP, and then click on “Verify OTP.”

For a detailed guide on the 5paisa account opening process, refer to our comprehensive blog, “How to Use the 5paisa App.”

Is 5paisa safe or legal in India?

Yes, 5paisa is a 100% safe and legitimate investment platform in India. It is promoted and backed by Mr. Nirmal Jain, the promoter of the IIFL group. It is a professionally managed and publicly traded company listed on BSE and NSE, setting it apart from competitors like Zerodha, Groww, Upstox, and others.

As a publicly traded company and stockbroker, 5paisa adheres to rigorous compliance and audit practices, distinguishing itself from many other unlisted stockbrokers. Regulatory bodies such as BSE, NSE, MCX, CDSL, and SEBI regularly audit the company.

FAQs About the 5paisa App

Yes, the 5paisa app is free to download and use. However, users may incur brokerage charges and other fees for trading and investing through the app.

Yes, the 5paisa app is available for download on both iOS and Android devices, making it accessible to a wide range of users.

Yes, the 5paisa app employs robust security measures to safeguard users’ sensitive information and transactions. It uses encryption, secure authentication methods, and other security protocols to ensure data protection.

Yes, users can access their 5paisa account from multiple devices by logging in with their credentials. The app offers synchronized access across devices, allowing users to manage their investments seamlessly.

Yes, the 5paisa app requires an active internet connection to access real-time market data, place orders, and perform other transactions. Users should ensure a stable internet connection for uninterrupted use of the app.