If you are into the world of stock marketing, trading, and investment, then you must have heard of the name Zerodha. If you are wondering what Zerodha is and how it works, then this blog post has got your back covered. Zerodha is surely India’s top trading and investing app, with millions of users. However, there are still many people unaware of what Zerodha is.

With that in mind, I have curated this blog post titled “What Is Zerodha, How Does It Work, and How Does It Make Money?” to help you better understand this application.

This blog post is going to be a guidepost of 3000+ words, so sit back and relax. Or, get yourself a cup of hot coffee or tea and enjoy this blog post.

Here are some highlights of this blog post:

A. What is Zerodha?

B. How does Zerodha work?

C. How Does Zerodha Make Money?

D. Zerodha Founder’s and Company Information

F. Is Zerodha safe and legal in India?

D. Zerodha Features and a lot more

What is Zerodha?

Zerodha is the number one and largest stock broking app in India and is known for its flat-free discount brokerage services in India. The application also offers services in the domain of investing in equities, currencies, commodities, IPOs, futures and options, mutual funds, bonds, and government securities. You can open a free demat account with Zerodha and kick-start your trading and investing journey.

The best thing about Zerodha is that it charges Rs 0 on equity delivery traders and direct mutual funds. For intraday trading, it charges Rs 20 or.3% commission on the trader, whichever is lower. The maximum brokerage you pay to Zerodha is Rs 20.

So, with its amazing online trading and investment services and low flat fee brokerage services, Zerodha has become the number one trading and investment app in India. Zerodha also works towards continuous improvements and innovation, enabling it to march towards becoming the fastest and number one fintech company in India.

How does Zerodha work?

You already know that trading in the stock market is not free. When you buy or sell shares or securities, you have to pay a certain commission to the broker for the actual amount of your transaction. This commission is a brokerage fee, which is the percentage of your turnover or total value of your trades.

This is not the case with Zerodha, which charges a flat fee, which helps in cost-cutting and saving the investor money. That’s the reason why Zerodha is a disruptor in the online trading market. Zerodha believes in charging zero brokerage, which helps their customers save more money.

Besides, Zerodha does not offer any advisory services, which further helps them reduce their costs. Most of the brokers in India have relationship managers who offer advisory services to their clients. This creates a conflict of interest as the relationship manager is paid commissions and fees when the client trades or pays brokerage.

Zerodha also leverages advanced technologies, such as AI and ML, rather than outdated technology, which helps them scale up their businesses through unnecessary costs.

One example of this is their online customer support system, which allows customers to express their doubts and issues via an online portal, and their queries are promptly answered. This reduces unnecessary costs while also ensuring good customer service.

How does Zerodha make money?

Now that you have understood what Zerodha is and how it works, it is important to understand the business model of Zerodha and how it makes money.

1) Flat fee and high volume transaction

Most of the revenue of Zerodha comes through a flat fee on intraday and F&O trades. It charges a late fee of Rs 20 on intraday trades, irrespective of how large the volume is. Also, instead of charging more commission per transaction, Zerodha focuses on building great products so that a large number of customers can trade and invest through their platform.

2) Startup incubation and investments

Besides offering trading and investing services and products, Zerodha has also invested in some startups, companies, and businesses, which has yielded them good returns on investment. Some of the most successful investments of Zerodha include those in companies like Small Case, a trading algo platform, Cred [a credit management company], Tradelab [a company that builds technology for capital market businesses], and LearnApp [a course platform in the domain of investment, trading, technology, and management}].

3) Mutual fund AMC

In the year 2019, Zerodha launched its first alternative investment fund, True Beacon. The aim behind building this fund was to take advantage of the volatility in the markets for high-net-worth individuals with a minimum investment of $2 million. In its first year, True Bacon earned a 13% ROI. Because of the success of True Beacon, Zerodha also applied for a mutual fund license and

4) Low cost of marketing

Although this does not have any direct impact on the earnings of Zerodha, it does help them save significant amounts of money on advertising and marketing. I know you won’t believe in the fact that the company grew to 6.5 million users without taking any VC money or burning on advertising and marketing. Community outreach, offline telemarketing, and word of mouth were the three main reasons behind the success of this company.

5) Low overhead costs

The overhead costs of Zerodha are also very low, which indirectly impacts their profitability and total revenue earned. They have a very small team with a limited number of offices across India. Also, the majority of their customer support tasks are automated, which further helps them save money and cut costs.

Moreover, they leverage technology and AI to build their products and provide the best and most hassle-free trading experience.

Zerodha Founder’s and Company Information

Nitin Kamath, the visionary founder and CEO of Zerodha, astutely recognized the challenges faced by investors and the general populace of India when it came to navigating the complexities of the stock market. He meticulously pinpointed three significant obstacles in this domain:

Firstly, there was a glaring lack of knowledge and awareness. People in India had scant information about stocks and markets, and there was a dearth of reliable resources for those interested in learning about these topics.

Secondly, the issue of exorbitant brokerage fees loomed large. Even those daring enough to venture into the stock market were often burdened with high fees and hefty commissions from brokers, leaving little room for profitability.

Lastly, the arduous procedures were discouraging. The cumbersome paperwork, convoluted documentation, intricate terms and conditions, and time-consuming processes deterred many potential investors.

In response to these challenges, Zerodha devised three innovative solutions. They introduced Varsity, a comprehensive platform offering a wealth of lessons and connections related to the stock market. This resource allowed individuals to gain a deep understanding of stock market intricacies, build networks, seek advice, and grow comfortable with the subject. Varsity quickly became the go-to source for new players, forging strong bonds of loyalty between Zerodha and its customers.

Furthermore, Zerodha revolutionized the industry by introducing incredibly affordable brokerage fees that were previously unheard of. They slashed the financial burden on investors by charging a mere Rs 20 or 0.03% for intraday trades and nothing at all for equity and direct mutual fund investments.

To simplify the entire process, Zerodha offered a user-friendly website and a mobile app with an elegant interface, making stock trading remarkably accessible. This focus on transparency and ease of use brought knowledge without hassles to investors.

These ingenious solutions propelled Zerodha from obscurity to a billion-dollar net-worth company without the need for extensive marketing or external funding. The users themselves became Zerodha’s most effective promoters, cultivating a dedicated customer base and encouraging stock market participation in India. Currently, Zerodha’s platform boasts 4 million active investors.

This success story underscores the fact that funding is not the sole route to business growth. Through thoughtful self-examination of your service, an understanding of the market, and an acute awareness of people’s needs, you can build a thriving business without onerous prerequisites. Recognizing and addressing inefficiencies and hurdles, rather than simply complaining about them, is the key to creating a business empire. Hence, market research remains an indispensable task that cannot be overlooked.

Zerodha Team:

1) Nitin Kamath

Nitin Kamath is the founder and CEO of this company. He started Zerodha in 2010 with the aim of helping traders overcome the hurdles they face in trading. Nithin is also a member of the SEBI Secondary Market Advisory Committee and the Market Data Advisory Committee.

2) Nikhil Kamath

Nikhil Kamath is the co-founder and CFO of this company. He started a career with a job at a call center while also trying his hands at equity trading. In 2006, he became a sub-broker and started his own brokerage firm along with his brother Nithin Kamath. He was quite good at trading, which really helped Zerodha during the initial days as the salaries of Zerodha employees were paid from the profits Nithin made with his trading skills.

3) Dr. Kailash Nadh

Kailash Nadh is the CTO at Zerodha and heads the entire technology space at the company. He started Zerodha Tech in 2013, where they have been building technology and product stacks for the capital markets in India.

4) Venu Madhav

Venyu is the Chief Operating Officer at Zerodha, and he is the backbone of all the operations work happening. His main responsibilities include ensuring that Zerodha is following rules and regulations. With over a dozen certificates in the financial market and hands-on experience with technical analysis, Veenu loves working out, cycling, and adventuring.

5) Hanan Delvi

Hanan is also the COO at Zerodha and takes care of the clients. He is also the brain behind many of the support initiatives at Zerodha that helped them stay ahead of the game. As a free thinker, Hanan can see posting as one of his free activities.

6) Seema Patil

Seema is the director at Zerodha, and she has worked in the airline business for more than 5 years now. She has vast experience dealing with people from various backgrounds to ensure that Zerodha’s team gets expanding support and maintains high-quality work.

7) Karthik Rangappa

Karthik is the brain behind Zerodha’s Varsity, a platform with massive educational resources about how Zerodha works, what Zerodha is, and also some courses related to finance, the stock market, trading, investing, and a lot more.

8) Austin Prakash

Austin is a self-made entrepreneur from Singapore. He is helping Zerodha grow by optimizing its revenue streams and courses and creating growth strategies.

Is Zerodha safe and legal in India?

The simple answer to this question is yes. Zerodha is 100% safe for both long-term and short-term investments, which makes it one of the safest stock brokerage firms in India. It offers free equity investment and charges a flat fee per trade, or 3% of the transaction value, whichever is lower. Zerodha follows a uniform risk management policy for all its clients without giving any special treatment to anyone.

The company’s risk management system is its backbone and remains streamlined to make sure that all the hard-earned money of the investors is safe and secured. All the technology is built in-house by their own team members, which reduces their dependence on external vendors. We have complete control over both technology and data, and they keep them updated regularly.

In recent years, Zerodha has also been working on building new security and authentication architecture for all your apps and platforms to safeguard their clients from rising cases of phishing attacks and stock market scams. Plus, they are the only brokerage firm to offer cryptographic TOTP 2FA support.

Moreover, Zerodha’s trading platform has been designed with simplicity in mind by incorporating good design and usability, which is another major reason for their safety and large user base. Moreover, Zerodha is frequently audited by multiple regulators throughout the year, which includes all three exchanges, depositories, and SEBI.

Hence, Zerodha is surely one of the safest brokerage firms and stock trading apps in India.

Zerodha Features

1) What is the Zerodha Kite?

Zerodha’s Kite is an investment and trading platform built for modern-day traders and sensibilities. The platform provides access to 90,000+ stocks and F&O contracts across multiple stock exchanges within a few clicks. It has its own search instrument where you can type the name of any stock or F&O and opt for it. You can also find your metals, derivatives, bonds, stocks, and other trading securities.

Besides, the user interface of this platform is kept minimalistic with an easy-to-use design, color combination, and navigation menu. You can easily buy and sell your shares with a click, analyze your investments, and manage your portfolio from one single dashboard. You can also use the keyword shortcut for easy navigation through the dashboard.

Another cool thing about this feature is that it offers 20 market depths and level 3 data, which will surely help traders make the best trades. Data is the new oil, and Zerodha’s kite gives deeper insights into the market, technical know-how, and market liquidity that will allow you to curate your known intraday strategies.

What’s more? It has also got 100s of indicators, advanced charting tools and interfaces, studies, and indices to help you with the technical analysis when it comes to trading and investment. You will also have extensive historical data for stocks and F&Os.

Another feature of Kite is GTT, which is Good Till Triggered orders that will allow you to place single-leg triggers to enter or stock your stock holdings.

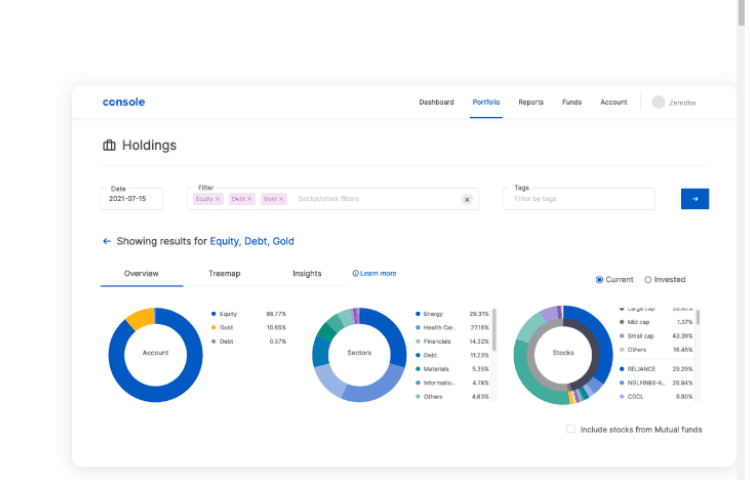

2) What is the Zerodha Console?

As the name says it all, Zerodha’s console is a dashboard where you can get a complete overview of your holdings and analyze your portfolio from one single dashboard.

There is also an analytics tool that gives you better insight into the trade and portfolio, which can be presented in an easy-to-understand manner in a pictorial format with better visualizations. You will also be getting a complete history breakdown of your stocks and trades, right from the day you purchased them or made the buying order.

Moreover, the console also crunches tens of billions of rows of historical trade to keep an eye on your corporate actions, splits, transfers, and a lot more to give you an accurate overview of your profit and loss statement.

Another feature of Zerodha’s console is that they provide tax-ready reports that cover everything from your capital gains to your grandfather, so you can get ready-made documents to submit to your CA or tax department.

3) What is the Zerodha Coin?

For those who would like to invest in long-term securities, government bonds, and mutual funds, they use Zerodha Coin. Through Zerodha Coin, you can directly buy mutual funds and invest in government securities with no commission. You can buy a mutual fund through Coin; you are directly investing in it or buying it through the asset management company.

You can also modify your SIP and start or stop it at any time that you want. You can also start a SIP at Rs 500 or invest a large amount in one go. Investors can also search through various types of mutual funds, like equity, debt, hybrid, small-cap, mid-cap, or large-cap. Use the search feature and filter options to select the best mutual fund depending on your investing needs and goals.

If you want better returns than FD, then you can invest in government bonds via Zerodha Coin. Government bonds come with a sovereign guarantee, which means you won’t lose your money on them, but the interest rate might change up and down. Also, you can pay taxes as per your income at the end of the financial year.

4) What is Zerodha Kite API Connect?

Zerodha’s API Connect, or Kite Connect, is for startups, entrepreneurs, and traders who want to build their trading platform. This API connection is backed by HTTP/JASON APIs that will allow you to build your own full-fledged trading and investing platform.

You can use it to execute real orders, obtain live market data, manage your portfolio from a single dashboard, and do so much more. By using this API connection, your own trading platform will be ready in a few minutes without the hassles of becoming a stock broker.

If you have been trading for a while, then you know that building new technology and innovation is a daunting task, especially for the capital markets. This is because many startups and traders don’t have access to the right technology framework.

Also, you need to have a brokerage license if you want to build technology for the capital market, which is yet another daunting task that requires time, money, and effort. Zerodha’s API connection will give you access to end-to-end broking as a service. Right from onboarding to customer support and everything in between, it will help you with everything.

5) What is Zerodha Varsity?

Are you a beginner in the stock market and trading? Do you want to learn about and explore the world of finance and investment? If your answer to the above two questions is yes, then Zerodha’s Varsity has got your back covered.

Varsity by Zerodha is an extensive collection of in-depth resources on the stock market, trading, and financial lessons created by Karthik Pangappa at Zerodha. It is 100% free and open to anyone who wants to learn about and explore the world of finance. You don’t need to sign up, there’s no need to pay a wall, there are no ads, and you don’t need to be Zerodha’s customer.

Hardcore or professional traders have around 15 modules of courses that each talk about an introduction to the stock market, fundamental and technical analysis, portfolio management, and a lot more. The courses are available in both English and Hindi, so anyone in India can learn about stock trading and the stock market. Each of the lectures is taught by an expert professional with years of experience in the field.

Besides, there is something also called Varsity Certified, which is a paid online examination in the trading and stock market world. This is a multiple-choice examination where 100 questions will be asked, and you need to answer them all within 100 minutes. You must score a minimum of 65% to pass the exam and get yourself varsity certified.

Who Can Use the Zerodha App?

1) Traders

Traders who trade in equities, futures, and options and constantly buy and sell shares in a day can use Zerodha for all their trading and investing needs. For traders, Zerodha has some amazing trading tools like charting, indicators, and drawing tools that will allow them to trade wisely in any stock, share, or equity.

2) Beginners

Apart from traders, beginners who are looking forward to investing their money in shares, equities, or IPOs for mutual funds can use Zerodha and take their first step towards their investment journey. For those who don’t know how to invest in shares, stocks, or any other securities, they can go through Zerodha Varsity, a platform loaded with guides, resources, and courses on investment, trading, and money management.

3) Value investors

If you are looking to make money by leveraging the power of compounding and long-term investment, you can also use Zerodha and make money. They can either invest in mutual funds or hold their shares and securities for the long term through this app.

4) Mutual fund investors

If you have limited knowledge about shares, stocks, commodities, or trading, you can initiate a systematic investment plan (SIP) in mutual funds as an alternative method to save money effectively. Zerodha allows you to begin your SIP with as little as Rs 100 per month, offering a diverse selection of mutual funds. You have the option to apply advanced filters to organize these mutual funds by factors such as the fund house, categories, risk level, lock-in period, minimum investment requirement, and fund plan.

Investing in mutual funds through Zerodha is a highly secure and regulated option since mutual fund companies are overseen by the Securities Exchange Board of India (SEBI), which serves as the governing authority.

FAQs about the Zerodha App

Zerodha is one of India’s largest and most popular stock brokerage firms. It’s known for providing online trading and investment services in stocks, commodities, and derivatives. Zerodha has gained prominence for its low-cost trading and innovative technology platforms.

Zerodha, just like most brokerage firms, makes money in a few ways. First, Zerodha charges you a fee or commission when you ask them to buy or sell stocks for you. This fee is usually a tiny part of the total amount you’re trading. Second, Zerodha also earns interest by lending money to customers for margin trading. Margin trading lets customers trade with more money than they actually have.

Yes, Zerodha is beginner-friendly and offers educational resources to help newcomers understand trading and investing. They also provide a “Varsity” platform with comprehensive learning material. It’s essential to start with a clear understanding of the stock market and gradually gain experience.

You can open an account with Zerodha by visiting their website and following the account opening process. You’ll need to provide the necessary documentation and complete the KYC (Know Your Customer) process.

Zerodha offers different types of accounts, including equity trading, commodity trading, and demat accounts. You can also open an account for trading in currencies and derivatives.

The charges with Zerodha include brokerage fees, DP charges, transaction charges, and other applicable fees. These charges can vary based on the type of transaction and the segment you are trading in.

Yes, Zerodha provides customer support through various channels, including email, phone, and a ticketing system. They also have a support portal and community forums to address common queries.

Yes, Zerodha offers mobile apps for trading on both Android and iOS devices. You can trade and monitor your investments on the go using their mobile apps.

Remember that while Zerodha can be a valuable platform for trading and investing, it’s essential to do your own research and consider your financial goals and risk tolerance before getting involved in the stock market.