In this comprehensive blog, we embark on a journey to unravel the nuances of Stripe, PayPal, and Square, bringing you a detailed comparison to help you make an informed decision. Whether you’re a tech-savvy entrepreneur, a seasoned online retailer, or a local business owner dipping your toes into the digital payment waters, this guide aims to demystify the complexities and highlight the strengths of each platform.

Join us as we explore the intricacies of transaction fees, delve into international capabilities, and navigate the seas of setup processes. We’ll discuss security measures, in-person payment options, and the suitability of these platforms for businesses of all sizes. By the end of this journey, you’ll be equipped with the knowledge needed to choose the payment powerhouse that aligns seamlessly with your business goals.

Ready to embark on the ultimate showdown? Let’s dive into the world of Stripe, PayPal, and Square, and uncover the ideal payment solution for your venture.

Overview

Stripe

Stripe is an American SaaS company that offers payment processing software, eCommerce websites, and mobile applications to send and receive payments across the world through the internet. Two Irish brothers, John and Patrick Collison, started the company in 2009. It started with the aim of helping online businesses accept payments from all over the world in the form of multiple currencies.

They allow merchants to accept payment via Mastercard, American Express, Diners Club, Discover, JCB, China Union Pay, and many other debit cards. Businesses can also pay via mobile wallets and get the option to buy and pay later.

The company is backed by Elon Musk, Paypal founder Peter Thiel, and venture capital firms like Sequoia Capital and SV Angel. Over the past few years, Stripe has also made some acquisitions like Kickoff, a chat and task management application, and the accounting platform Recko.

Paypal

Paypal is a USA-based online payment gateway system that offers services like online money transfers and acceptance. It is an electronic alternative to traditional paper methods such as checks and money orders. It started in 1998 and can be considered the first online payment gateway in the world. The company was founded by Max Levchin, Peter Thiel, and Luke Nosek. In 1999, it merged with x.com, an online financial company that was founded by Elon Musk. Harris Fricker, Christopher Payne, and Ed Ho.

Over the past years in its business operations, Paypal has made more than 20 acquisitions, which has made it dominate the online payment market. They have acquired companies like Braintree, iZettle, Hyperwallet, and many more. Paypal is also one of the most profitable fintech companies in the world. It reported earnings of 29 billion in 2023, with an operating income of 5 billion and a net income of 4.246 billion.

Square

Square is a financial service platform for small and medium enterprises that allows its users to accept payments via credit card using smartphones as POS registers. The company was founded by Jack Dorsey, the former founder and CEO of Twitter, and Jim McKelvey. Among the core products of Square are point of sale, an online store, online checkout, and a lot more. The company was launched in 2009 when Jack Dorsey’s friend Jim McKelvey was unable to complete a transaction of $2000 in sales of his glass faucets and fittings because he could not accept credit cards.

In 2011, the company launched two apps, Square Card Case and Square Register. In 2012, Starbucks announced that it would use Square to process transactions of customers who pay via debit and credit card.

Features

Stripe

1. Online payment

The most important and most used feature of Stripe is online banking, which allows users to accept payments online and in person all across the world. With its optimized checkout process, online businesses can increase their revenue and save thousands of engineering hours with pre-made payment ULs. It has more than 100 payment methods, making it easy for merchants to accept payments via multiple sources.

Merchants can use shareable payment links or QR scanners over email, SMS, or any other channel to accept payment. It gives the option of a one-time payment, recurring payments, or pay-what-you-want payments. Besides shareable links and QR code scanners, merchants can use pre-built payment forms and embed them on their sites.

Stripe also has payment options available in 195 countries across 135 currencies, which can help merchants reduce the complexity and cost of multi-currency management with flexible cross-border payment options.

2. Revenue and finance automation

The next feature is finance automation, which allows businesses to streamline most of their routine finance processes, like billing, tax, revenue reporting, and data tools that work together. This saves time and allows businesses to close their accounting books faster. Stripe also sets up an integration between billing, payment, text, and revenue reporting, which allows businesses to recover more revenue, spend less on compliance, and speed the payment process.

With Stripe’s comprehensive revenue and finance automation solution, you don’t have to settle for oversized, arcane systems or small-scale, piecemeal tools.

3. Banking as a service

Stripe Connect serves as a robust platform offered by Stripe, empowering businesses to construct tailored marketplaces and platforms. This versatile solution is particularly advantageous for businesses operating as multi-sided marketplaces, including crowdfunding platforms, marketplaces, and on-demand service providers.

With Stripe Connect, businesses can seamlessly handle payments, facilitate payouts to third parties, and efficiently manage the entire financial workflow within their ecosystems. The platform provides customizable onboarding processes, allowing businesses to tailor user experiences, implement identity verification, and manage compliance seamlessly. Stripe Connect supports flexible payments, enabling businesses to manage fees, taxes, and financial transactions effortlessly.

Additionally, the platform includes features for scheduled and one-time payouts, aiding scenarios where regular payments are required. With a focus on compliance and risk management, Connect incorporates identity verification and fraud prevention tools. Its API-based model allows for easy integration, and businesses can also leverage other Stripe services for a comprehensive solution. As the fintech landscape evolves, Stripe Connect remains a powerful tool for businesses looking to build and scale their own marketplace platforms.

Paypal

1. Worldwide shopping

With the help of Paypal, you can shop for goods and services worldwide. Many eCommerce marketplaces and service providers accept money via Paypal, which allows you to make purchases from anywhere in the world and at any time. I am personally using PayPal for the payment of my web hosting services. Yes, they charge a certain commission from the receiver end, but that won’t hamper your shopping experience.

More than 20 million merchants across 200 marketplaces accept money via PayPal. Now you can shop for products from your favorite international brand right from your home. Once you find a great product, just click the PayPal button and buy your goods with confidence. Paypal protects all your data, so when you shop via Paypal and your product does not match its description, Paypal will return you for an eligible purchase.

They work with major banks in India and overseas, so you can pay with your preferred credit or debit card and continue earning reward points.

2. eCommerce solutions

Paypal offers a plethora of e-commerce solutions for small and medium-sized businesses that allow them to accept payments from worldwide users. If you are running an international business across different time zones, Paypal gives you the opportunity to connect with more than 400 million customers.

Paypal has an amazing two-sided network that not only allows you to connect with customers across the globe but also has many platforms and marketplaces where you can sell your goods and services. With Paypal for Business, you can find new business markets, customers, and new channels to tap into and expand your business further.

For businesses, PayPal allows them to accept payments, make payments, and streamline the back office to run more smoothly.

3. Send and receive payments worldwide

With PayPal, you can also send and receive payments globally in multiple currencies. Paypal does charge a certain commission if you are getting paid from someone else, but it does not charge a penny if you are sending money to somebody else. You can connect your bank account or debit card, which is valid in your country, and expect the funds to be transferred within 4-5 business days.

4. Streamline business operations

With Paypal for Business, you get some amazing business tools to track your day-to-day operations, allowing you to run your business more smoothly. You get tools for analytics, reporting, and cash management in a single dashboard to get rid of the mundane tasks and focus more on the productive aspects of the business.

Dispute management, reporting, and analytics are some of the tools you get with the Paypal business.

Square

1. Commerce

If you are a small or medium-sized business owner, then Square Up has a number of commerce solutions for you. From starting your online store to setting up the checkout and payment process and everything in between, Square Up can help you with everything you need to scale your business. Food and beverage, quick service, full service, retail, hair salon, nail salon, spa, medical spa, fitness, tattoo, and many other businesses can use Square Up to streamline their business operations.

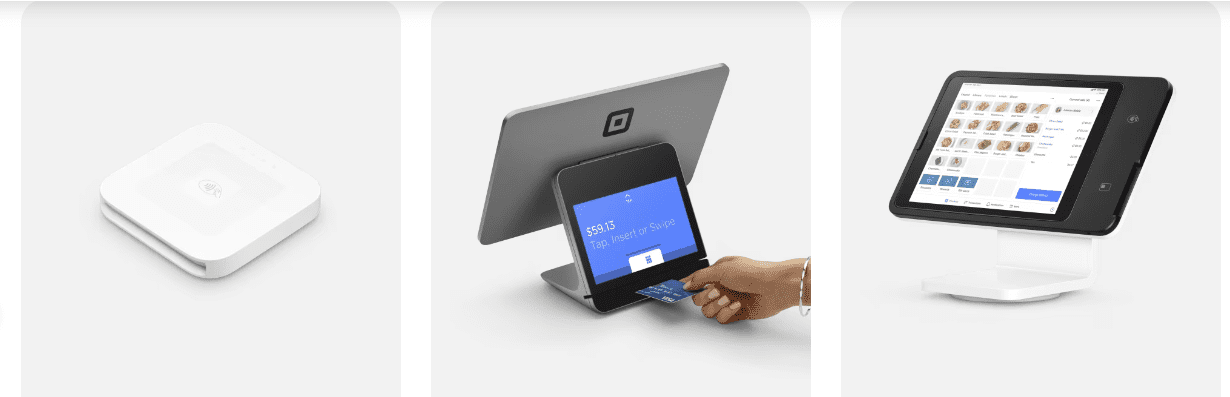

2. Point of sale

Most SquareUp users leverage the point-of-sale feature, which is designed to help sell their products and services seamlessly with built-in tools for advanced inventory and sales management. It has tools for various types of businesses. For example, restaurant businesses should have tools at the front and back of the house to pick up and deliver. If you are running a salon or spa business, you can automate your bookings by scheduling POS systems, which will give the customer a seamless booking experience.

The Square Up POS system also comes with built-in payment solutions through which you can accept card payments right away. Plus, if you can process over $250,000 in sales per year, you can also get a custom pricing option for POS.

3. Payment

Another most-used feature of Square Up is the payment process. Square Up gives businesses multiple payment options, including in-person, online, remote, and buy now, pay later options. For in-person payment, they give you a POS system that works seamlessly with all the debit cards. Businesses can also accept contactless payments via Android and iPhone with a tap.

You can either keep your money in a Square Up account or transfer it to your respective bank for a fee of 1.75% of the amount. There is also a reporting and analytics tool to track the sales of your business. While accepting or making payment, you don’t need to worry about any security breach, as Square Up offers data protection, data security, and dispute management and supports PCI compliance.

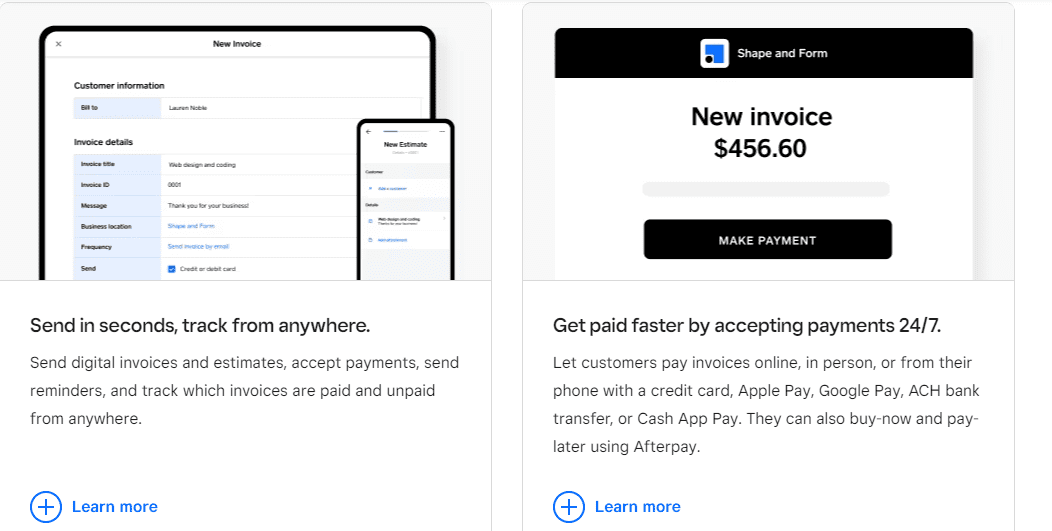

4. Invoicing

This is a free-to-use feature that helps businesses send, track, and manage their invoices from one place. This easy-to-use feature aims to help businesses get paid faster by letting them know the status of the payment. Businesses can create e-invoices by signing up for a free Square Invoice account and later setting up recurring payments and auto-reminder options to get paid on time. Invoices can be sent to customers mobile phones or email addresses as well.

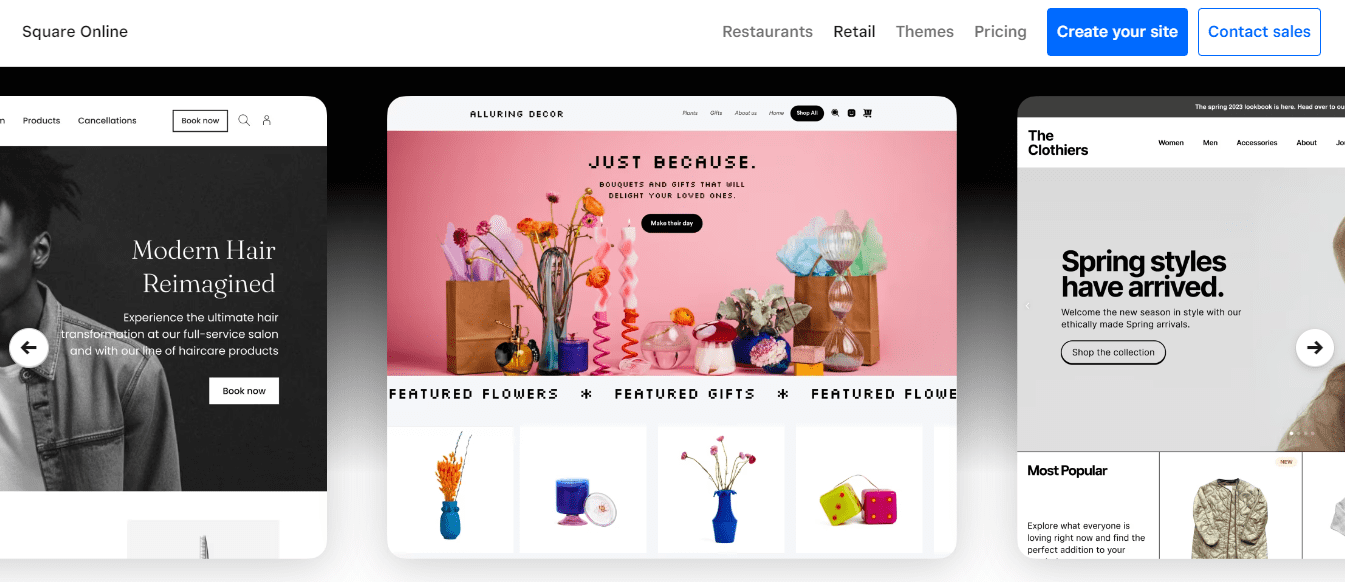

5. Online store solutions

Do you want to start your online store by creating your site? If yes, then Sqaure Up has online store solutions with custom domain names. You can launch your own store and grow your business globally.

Square Online Store is a platform provided by Square, a versatile financial services company, allowing businesses to establish and manage their digital storefronts. With Square Up, users can create a professional online presence by easily designing and customizing their websites, adding product listings, and configuring payment processing through Square’s secure system. The platform streamlines the setup process, making it accessible for small businesses and entrepreneurs seeking to expand their reach online.

Square Up not only facilitates seamless online transactions but also integrates with other Square services, such as Point of Sale, for a comprehensive business solution. This enables merchants to efficiently manage both their online and offline sales channels. The platform emphasizes simplicity, making it a valuable tool for businesses aiming to establish a robust online presence and enhance their overall commerce capabilities.

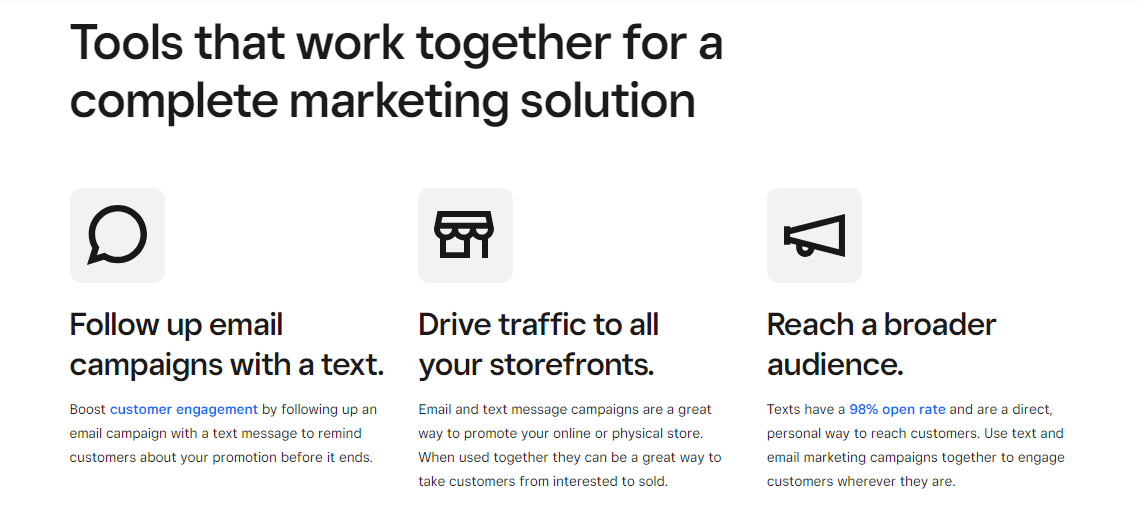

6. Marketing Solutions

Square Up also comes with some marketing features that you can leverage to promote and market your products and services. You can use it as email marketing software or a messaging tool to promote in-store events, new products, send last-minute deals, or provide seasonal offers to your valued customers. Square marketing solutions can also help you drive traffic to your online and physical stores.

You can also save time with marketing automation and welcome new customers with a custom response. There are also some free-to-use CRM tools built into your Square Point of Sales that give you a holistic view of your customers. You can view their information, learn how they interact with your site, and create custom groups based on their purchasing history.

User experience and support

Stripe

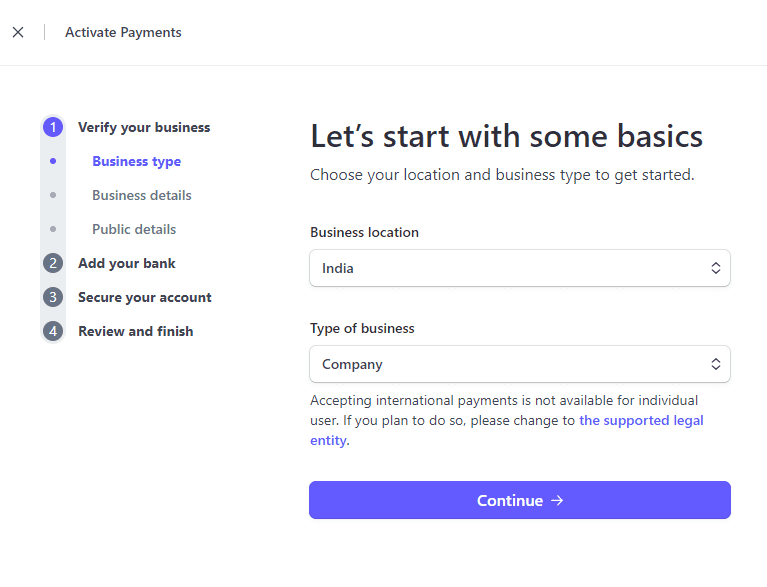

The user interface of Strip is kept very minimal and easy to use. They have a clutter-free interface, and everything is kept super easy in a proper flow, which will allow you to set up your payment account within a few clicks. The moment you create your account on Stripe, you will get multiple options regarding your purpose for using Stripe.

If you are using it for accepting payments online, then in 4 steps you can get started with it, as shown in the above image.

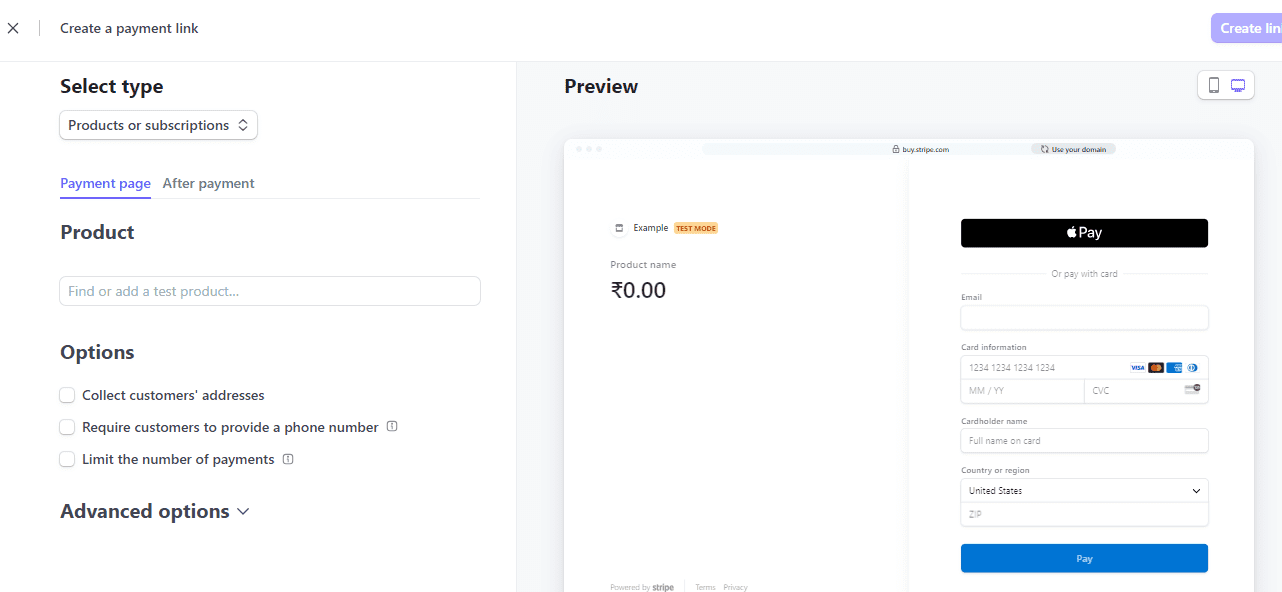

You can also create the payment link very hassle-freely and share it with your customers and with the person from whom you are supposed to get the payment.

Overall, the user interface is nice and clean.

Speaking about customer support, Stripe has multiple options to help you. You can read the articles related to your issue, contact the sales team, use API reference documents, or have a chat with their developer on Discord.

Paypal

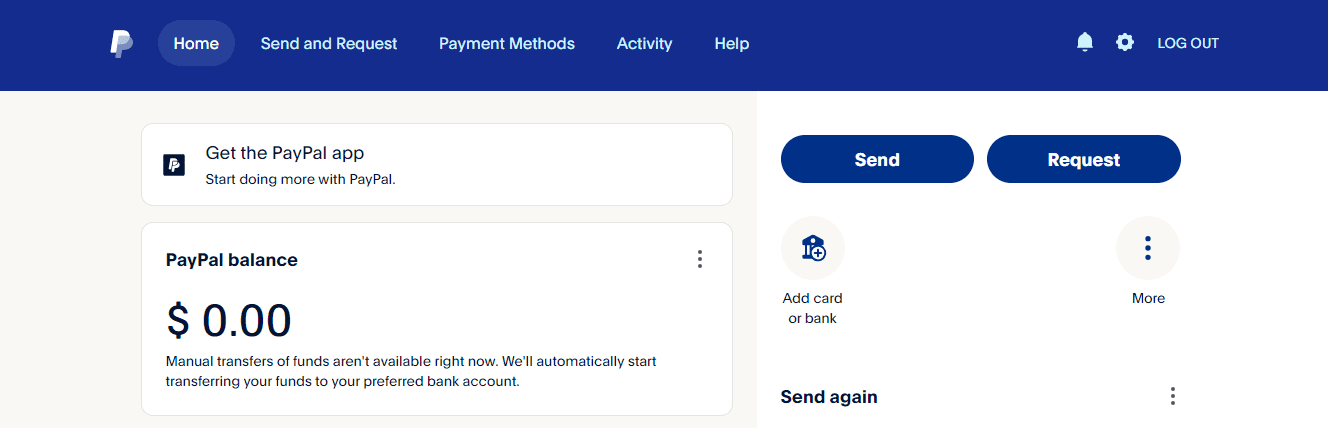

I have been using Paypal for more than 4 years now, and I can say on record that Paypal has the best user interface. The moment you log in to your PayPal account, you get everything right in front of you, so you don’t have to search elsewhere on the site. From sending payments to requesting payment by generating invoices, everything can be done from the dashboard.

Paypal has also done a great job by using the dark blue color combination with white, which makes the tab look more intuitive and clickable. Also, it does not put much strain on the eyes.

Speaking about their customer support, Paypal offers multiple support services. You can read their definitive guide and articles related to your issue; you can message them or chat with the assistant; ask your doubts in the community forum; or raise your ticket.

Square

Square Up boasts a user-friendly interface that simplifies the payment process for both businesses and customers. The Squareup user interface is intuitive and well-designed, allowing users to navigate seamlessly through various features such as point-of-sale transactions, inventory management, and analytics. The platform’s clean layout and straightforward design contribute to a positive user experience, making it accessible to businesses of all sizes.

Square Up also provides a range of support options, including live chat, email, and phone support. Customer inquiries are addressed promptly, and the support team is known for its helpful and knowledgeable assistance. This commitment to user-friendly design and responsive customer support reinforces Square’s reputation as a reliable and customer-focused payment solution provider.

Pricing plans

Stripe

Stripe | Pricing |

Monthly processing fee | $0 |

Online processing fee | 2.9% + 30 cents |

Invoicing fee | 3.3%–3.4% + 30 cents |

Recurring billing/ subscription fee | 3.4%–3.7% + 30 cents |

Card-on-file processing fee | 3.4%–3.7% + 30 cents |

ACH/e-check processing | $1/payment (ACH debit) 0.8% capped at $5 (ACH credit) |

Virtual terminal fee | 3.4% + 30 cents |

In-person and POS fee | 2.7% + 5 cents, or 2.9% + 30 cents |

POS software | Third-party |

Chargeback fee | $15 |

Paypal

Paypal | Pricing |

Monthly processing fee | In the between $0 to $30 |

Online processing fee | 2.99% + 49 cents per transaction |

Invoicing fee | 3.49% + 49 cents |

Recurring billing/ subscription fee | 3.49% + 49 cents $10–$30/mo |

Card-on-file processing fee | 3.49% + 49 cents |

ACH/e-check processing | 3.49% + 49 cents capped at $300 |

Virtual terminal fee | 3.09% + 49 cents $30/mo |

In-person and POS fee | 2.29% + 9 cents |

POS software | - |

Chargeback fee | $15–$20 |

Square

Square | Pricing |

Monthly processing fee | $0 |

Online processing fee | 2.9% + 30 cents |

Invoicing fee | 2.9%–3.3% + 30 cents |

Recurring billing/ subscription fee | 2.9% + 30 cents |

Card-on-file processing fee | 3.5% + 15 cents, or |

ACH/e-check processing | 1%, min. $1 |

Virtual terminal fee | 3.5% + 15 cents (keyed-in) |

In-person and POS fee | 2.6% + 10 cents |

POS software | $0–$60/mo |

Chargeback fee | Waived up to $250/mo |

Business model

Stripe

Stripe is a software-as-a-service company that allows businesses and individuals to accept and make payments over the Internet. It offers a full range of payment solutions for individuals and online businesses alike. Their business model is based on charging a certain fee for every successful payment made via their platform.

Some other sources of their income are: services offered to startups; fees on premium support and services; interchange fees; interest on loans; and profits from investments in startups. The company’s payment platform has a clean and easy-to-use interface, making payment processing hassle-free.

The company calls itself a full-stack payment service provider and is comprised of three layers.

Cloud-based payment solution.

Customizable payment platform.

Ready-made applications include billing software, reporting, and fraud prevention using ML technology.

Paypal

Paypal is yet another internet-based financial service company that allows its users to send and receive payments via the internet in different currencies and convert them into the domestic currency of the receiver. It makes money via transaction fees, premium features, and business accounts.

Paypal is directly connected to the user’s bank account, and money is sent and received directly through and in the bank. It enables two-factor authentication, which adds an additional layer of security. Apart from allowing users to send and receive payments, Paypal offers additional services like paying in installments via Paypal credit, shopping online from international brands using Paypal, and a lot more.

Square

Square Up’s business model is slightly different from Paypal and Stripe. They charge a service fee or transaction fee for the services they offer. For example, their standard processing fee is 2.6% for contactless payments and 3.5% for payments made via manually keyed-in transactions. Besides, they sell a bunch of other financial services and products, like Square Stand, Square Card for NFC and EMV chips, barcode scanners, receipt printers, and so on. They work as a blade and rezor model by selling the hardware products at low prices in the market and charging a fee for the service rendered.

FAQs Stripe Vs Paypal Vs Square Up

Each platform has its strengths. Stripe is known for developer-friendly APIs, PayPal offers wide consumer recognition, and Square provides a simple solution for small businesses. Choose based on your business needs.

Yes, there are variations. Stripe and PayPal typically charge around 2.9% + 30¢ per transaction for online payments, while Square’s fees can vary. Consider your transaction volume and business type when comparing.

All three platforms support international transactions. However, consider the currency conversion fees and supported countries to ensure the best fit for your business’s global operations.

Yes, all three platforms provide in-person payment solutions. Square is often praised for its user-friendly card readers, while PayPal and Stripe also offer hardware options for physical transactions.

Yes, the setup processes differ. Stripe is developer-centric, PayPal is user-friendly for various businesses, and Square is known for its quick and easy setup. Consider your technical expertise and preferences when choosing.

Square is often recommended for small businesses due to its straightforward setup, affordable hardware options, and a range of additional business services. However, the choice ultimately depends on the specific needs of your business.

All three platforms prioritize security, employing industry-standard encryption and security measures. They are trusted by millions of users worldwide, but it’s crucial for businesses to follow best practices for online security.

Yes, all three platforms support subscription billing. However, the features and ease of use may vary. Evaluate each platform’s subscription management tools to find the one that aligns with your business model.