Introduction

The Indian stock market has been booming since the post-pandemic era, and Zerodha has played an important role in the growth of the Indian stock market by creating a hassle-free solution to trade and invest in the share market with less brokerage. Headquartered in Bangaluru, Zerodha is an Indian stock trading app and financial service company that is registered with the Securities and Exchange Board of India and a member of prominent stock exchanges in India like the NSE and BSE.

So, if you are a trader or investor, then you must be aware of what Zerodha is and how it works. However, have you ever thought about the success story of Zerodha or how it became a billion-dollar company without raising a single round of funding or burning millions of dollars on advertising?

In today’s blog post, I will walk you through the Zerodha case study and some of the strategies that have helped them become a billion-dollar brand.

Overview of Zerodha

The name Zerodha has been derived from the Sanskrit word Rodha, which means barrier in Sanskrit. And zero is just a number. So Zerodha means zero barriers to the people who are looking to invest. The company was founded by two brothers with a knack for trading and investing in the stock market, namely Nithin and Nikhil Kamath, on August 15, 2010. Since then, they have disrupted the Indian trading market with low-cost pricing, flat-fee brokerage, and zero brokerage on investment in mutual funds. Today, Zerodha contributes 5% of daily market turnover across various stock exchanges in India, making it the biggest and most used stock trading app in India.

Zerodha is a completely bootstrapped startup, meaning they don’t have any backing or raised funding. Today, they are valued at $2 billion and have clocked Rs 1000 crore in revenue with a profit of 440 crore rupees. That’s truly insane. There are several factors that led to their exponential growth in the Indian financial market. One of them is that they treat all clients with the same deal, and their brokerage calculator is completely transparent, making them different from their competitors.

Zerodha’s Membership Information:

Zerodha NSE Member ID:Capital Market (CM): INB231390627 Future & Options (F&O): INF231390627 Currency Derivatives (CDS): INE231390627

Zerodha BSE Member ID:Capital Market (CM) – INB011390623Future & Options (F&O) – INF011390623

CDSL: IN-DP-CDSL-00278209

NSDL: IN-DP-NSDL-11496000

Zerodha NSE Registration Date: June 30, 2010

Zerodha BSE Registration Date: May 17, 2012

Background on Zerodha

The story started in 2005, when Nithin Kamath was a full-time trader and one HNI was impressed with his trading skills and portfolio. The HNI immediately wrote a check for Rs. 25 lakh and told Nithing to manage his demate account. Later on, Nithin left his job and stated that he was managing clients on a full-time basis and helping them with their investments in the stock market. This was the time when Nithin realized there was no single platform where he could switch different accounts seamlessly. To cope with this problem, Nithing joined Reliance Money as a sub-broker, which allowed him to buy and sell stocks on one single platform.

Over all these years, Nithin realized there was a huge gap between the commission charged by the brokers and the actual amount clients received after every trade. He also realized that many young people in India are interested in investing in the stock market, but they aren’t able to find one single platform for investing in the share market. That’s because of high brokerage charges and complex trading processes.

So, after working for almost more than 10 years in trading and the stock market, Nithin decides to become a broker himself. And not just an ordinary broker, but the one who decided to revolutionize the broking industry in India. Nithin, along with his brother Nikhil, who was a better trader, decided to start Zerodha.

The reason to start Zerodha was simple: to create a seamless trading platform at an affordable rate by charging a flat fee commission rather than charging brokerage based on the volume of trades. The aim was to remove all the barriers and eliminate the hurdles faced by investors and traders by paying a huge brokerage. Zerodha’s actual operation began in 2010. Prior to 2010, Nithin was looking to raise funding when the Indian financial market was going through a crisis. Also, none of the investors and VCs were confident enough in the idea of an online trading platform back then.

Nithin decided to use his savings to get things moving and bought refundable deposits to set up a small office space. It is show time now. In 2010, the business operations started growing with Zerodha’s user-friendly trading platform and technology. They only charged a flat fee of Rs 20 per trader, irrespective of the volume and size. This attracted many traders to get on Zerodha’s platform. In the first year of their operations, Zerodha managed to open 3000 demat accounts.

And they achieved all these without any funding or burning millions of marketing campaigns. At the beginning, they opted for community outreach, as Nithin was part of several online trading communities. This worked in favor of Zerodha. They also opted for a door-to-door marketing policy, and a combination of these strategies helped them acquire the initial customers.

The year 2015 was the major year for business operations, where things started taking more pace. The founders decided to make delivery on equity investments free of charge from a fee of Rs 20 to zero. This gave Zerodha growth, and in just 5 years, the customer base went from 30,000 to 14,00,000 lakh accounts in 2020. In the year 2019, Zerodha also becomes a market leader by leaving behind ICICI Securities, the then-market leader.

But tremendous growth was yet to come.

In the year 2020, COVID-19 fueled interest among individuals in stock investing and trading. This surge led to the massive growth of online trading platforms in India, including Zerodha. As a result, Zerodha surpassed its customer base by one crore, with 62 lakh active customers placing millions of orders per day. In the same year, after 10 years of operations, Zerodha became a profitable unicorn startup. In fact, it is one of the few profitable unicorn startups in India.

In FY22, the startup reported ₹4,964 crore in revenue and ₹2,094 crore in profits. And they achieved all this without VC funding and advertising.

One of the key reasons for Zerodha’s success is its customer-centric approach. Zerodha has always focused on providing excellent customer service and support.

One of the main reasons for Zerodha’s success is its customer-centric policy and approach, which gave it an edge in the market. Zerodha provides amazing customer service and support, which helps them retain customers and acquire new clients quickly. Plus, word-of-mouth marketing has helped them a lot. They have a dedicated customer support team that is always ready to go the extra mile to solve every query of their clients.

They have an active online community where clients can share their experiences and provide feedback.

Founding and History

Zerodha kicked off their operations in 2010 with the aim of breaking all the barriers that traders and investors faced while trading in the Indian stock market. Their aim was to tackle the high brokerage rate, provide better support, and leverage technology to create a seamless trading platform in India.

Today, they have disrupted the online stock market industry in India with their flat-fee pricing model and in-house technology. They have over 1 crore clients that place millions of orders every day on Zerodha, which is close to 15% of all the Indian retail trading volume.

Mission and Vision

Zerodha’s mission is to offer high-quality services through technology, innovation, and capacity enhancement in the domain of trading and investment, while their vision is to follow the standards of ethics and compliance fairly and transparently.

Growth and market presence

Zerodha’s triumph wasn’t solely attributed to its emphasis on technology and education; it also revolutionized the conventional brokerage model through the implementation of a flat fee structure. Instead of levying a percentage-based brokerage fee on the trade value, Zerodha opted for a groundbreaking flat fee of Rs. 20 per trade. This innovative fee structure proved to be a game-changer for the industry, drawing in a substantial number of investors seeking cost-effective trading services.

Another pivotal stride by Zerodha was the introduction of direct mutual funds, marking the company as the pioneer in India to provide such a service to its clients. This move not only enabled clients to save on fees but also enhanced their overall returns. Zerodha continued its streak of innovation with the introduction of discount brokerage services, the integration of UPI payments, and the launch of its proprietary mutual fund platform, Coin.

Business Model

Zerodha’s business model is based on low-margin and high-volume targets. They charge a flat fee rate of Rs 20 per trade for equalities and derivatives trading, irrespective of the volume of trade. For commodity trading, they charge 0.03% of the value of the transaction. This minimal pricing model has helped them to stand out in the market and be profitable. Besides, they also charge a certain fee annually for demand account maintenance.

Another thing that adds to their profitability is their business operation, which is mostly online. They have only one office, rather than having multiple offices across India.

This reduces the cost of running the business and adds to its profitability. Besides, they don’t burn money on marketing and advertising. All their customers and client bases have grown organically and with word-of-mouth marketing over the years.

Features of Zerodha

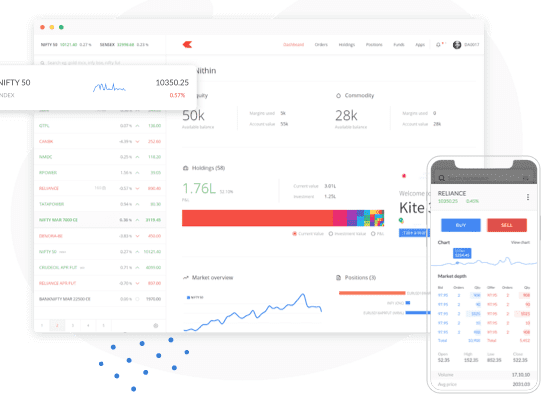

1. Zerodha Kite

The most popular and widely used feature of Zerodha is its Kite trading platform, which is built with modern features and sensibilities to give investors a seamless trading experience. It has a user-friendly interface and more than 90,000 stocks to search from. You can also search for futures and options contracts across multiple exchanges quickly and without any hassle. To further make your trading process easy, Zerodha Kite has level 3 data, or 20 market depth. Level 3 data gives you deeper insights about the market and helps to curate the best trading strategies.

There is also an advanced charting system and tools with historical data for stocks, futures, and options contracts. You can use and make profitable traders.

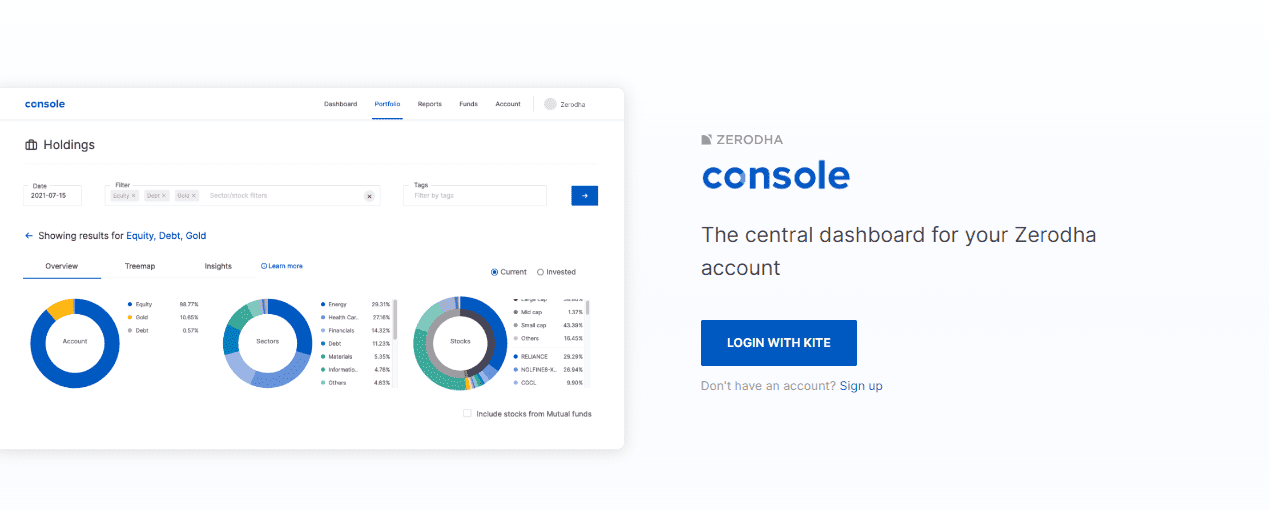

2. Zerodha Console

Zerodha Console is an in-depth analytics and reporting dashboard where you can see all your investments and portfolios in one place. You can check your investments in equity, mutual funds, debt, and gold from one single place. It gives you multi-dimensional insights on your trades and portfolio in pictorial format, allowing you to easily understand everything.

You can also check the complete history of your stocks right from the day of acquisition and understand your trades better with a per-trade charge breakdown. Console also gives you tax-ready reports for a full financial year, completely ready to be submitted to your chartered accountant.

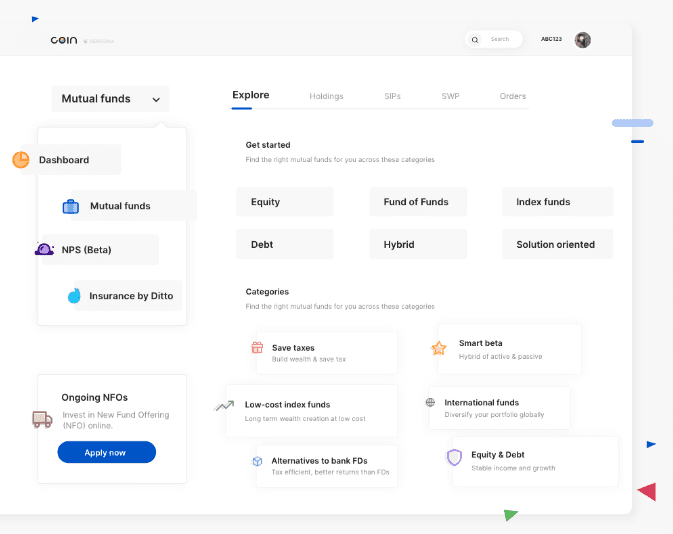

3. Zerodha Coin

For those who want to directly invest in mutual funds, government securities, or gold bonds, Zerodha Coin is the place to be. You can buy mutual funds via coin with no commission passed back, directly from the asset management companies. You can either invest once or start your SIP with a set-up feature that will allow you to automatically increase the SIP amounts by your preferred percentage. You can start your SIP, stop it, or pause it as needed. SIP values can be increased and decreased at your own will.

4. Zerodha varsity

Do you want to learn about stock marketing? Are you interested in trading but confused about where to start? If your answer to the above two questions is yes, then Zerodha Varsity is the place to be.

Zerodha Varsity is an online educational platform created by Zerodha, which is one of the largest retail stockbrokers in India. Zerodha Varsity provides comprehensive and free educational content related to various aspects of trading, investing, and financial markets. The platform is designed to help both beginners and experienced traders understand the complexities of the stock market, derivatives, technical analysis, fundamental analysis, and other related topics.

Zerodha Varsity offers courses in the form of modules, chapters, and lessons, covering a wide range of subjects in a structured manner. It includes text-based content, illustrations, and practical examples to make learning about the financial markets more accessible and engaging. Users can access Zerodha Varsity for free, making it a valuable resource for anyone looking to enhance their knowledge of the stock market and improve their trading or investment skills.

5. Zerodha API Connect

Are you a startup keen on building a trading platform? If yes, then you can surely use Zerodha’s API Connect to build a trading platform, execute real orders, get live market data, manage portfolios, and much more. You can make your own platform within a few minutes without the hassle of becoming a registered stockbroker.

Once you create your platform with Zerodha’s API Connect, it will become immediately accessible to the 4+ million customers of Zerodha, who can use it to place orders and execute trades within a few clicks.

Kite Connect provides a comprehensive broking-as-a-service solution, managing everything from onboarding and KYC to account opening and customer support. By utilizing our APIs, you can concentrate on developing your investment platforms while we handle the operational and regulatory aspects.

Challenges Faced by Zerodha

1. Onboarding customers

One of the major challenges that Zeordha faced was onboarding new clients during the initial days of its business operations. Zerodha did not have any funding or backing from a venture capital firm, so it was tough to get the customers on board with the platform. They decided to get a few customers on board with the help of community outreach and door-to-door marketing. By leveraging these two strategies, they gained the first 1,000 customers.

2. Credibility

Another reason that Zerodha faced was the credibility issue. Back in 2010, nobody believed in the concept of online trading. There is not a single trading platform or portal that traders and investors could use for investing. In fact, investing money via online portals would have sounded like a scam back then. However, by harnessing the power of technology and simplifying the trading process, Zerodha gained popularity and retained its existing customers.

In fact, the existing customers found the platform so useful that they recommended it to others.

Strategies for growth

1. Trading communities

During the initial days of their business, Zerodha’s founder, Nithin Kamath, leveraged the power of trading communities, which he was part of, to grow the business. Back then, there were no online platforms or social media. Nithin Kamath had good networking in the trading and stock market communities, which is used positively for marketing Zerodha.

2. Door-to-door marketing

Zerodha also did door-to-door marketing in their neighborhood during the initial days by distributing pamphlets and marketing materials. Back then, their team was small, so both the Kamath brothers used to knock on the doors of people and encourage them to use Zerodha for trading and investment.

3. Referral Program

The next top-rated strategy that Zerodha leveraged for scaling its business was the launch of the referral program. This strategy helped them grow their customer base to the next level. Through the referral program, Zerodha’s existing customers were enticed to refer the platform to their friends and family, and they would get a commission in return for every person who opened a Demat account via their referral link.

4. Word-of-mouth marketing

Zerodha’s platform was so good that it created hype in the trading communities, and people started loving the platform for its affordable services, seamless interface, and everything online. The majority of the customers that started using Zerodha did so because of word-of-mouth strategies and referrals from friends and family.

5. Technological leverage

Zerodha is also known for their technological advancements, which make them stand out from the crowd. Besides, they have curated an amazing user interface and an easy-to-use platform, which makes it easy for beginners to trade and invest.

Who can use Zerodha?

Zerodha is a financial services company based in India that primarily operates as a stock brokerage firm. It provides a platform for trading in stocks, commodities, and currencies. Zerodha’s services are available to:

Retail Investors: Individuals who want to invest or trade in the stock market can open an account with Zerodha. Whether you are a beginner or an experienced investor, Zerodha caters to a wide range of users.

Traders: Active traders who engage in frequent buying and selling of stocks, commodities, or currencies can use Zerodha’s platform for their trading activities.

Investors: Those who prefer long-term investments and want to buy and hold stocks for an extended period can also use Zerodha’s services.

Intraday Traders: Zerodha is popular among intraday traders who take advantage of short-term price movements to make quick profits.

Derivatives Traders: Zerodha provides facilities for trading in derivatives such as futures and options.

Small and Medium Enterprises (SMEs): Zerodha offers services to small and medium-sized enterprises for investing and managing their capital.

To use Zerodha, individuals need to open a trading and demat account with the company. It’s important to note that, as of my last knowledge update in January 2022, the information might have changed, and it’s advisable to check the latest terms and conditions on the official Zerodha website or contact their customer support for the most up-to-date information.

FAQs about the Zerodha Case Study

Zerodha is a leading Indian stock brokerage firm that offers online trading and investment services. It is known for its discount brokerage model and user-friendly trading platforms.

Zerodha case studies are in-depth analyses of specific scenarios or experiences related to Zerodha’s platform, services, or user interactions. These studies often highlight challenges, solutions, and outcomes, providing insights into the brokerage industry.

Zerodha case studies offer users valuable insights into real-life trading situations. By examining these cases, users can learn about effective strategies, risk management, and common pitfalls, helping them make informed decisions in their own trading activities.

Yes, Zerodha case studies can be beneficial for beginners. They provide practical examples and lessons that help novice traders understand the dynamics of the stock market, learn from others’ experiences, and enhance their trading skills.

Zerodha often shares case studies on its official blog, social media channels, or other platforms. Users can access these studies to gain insights into various aspects of trading, investment, and the use of Zerodha’s tools.

Zerodha case studies cover a wide range of topics, including but not limited to trading strategies, market analysis, technical analysis, platform features, customer experiences, and innovations within the brokerage industry.

Users can access Zerodha case studies on the official Zerodha website, blog, or other online platforms where the company shares information. Additionally, these case studies may be featured in educational materials, newsletters, or community forums associated with Zerodha.